Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

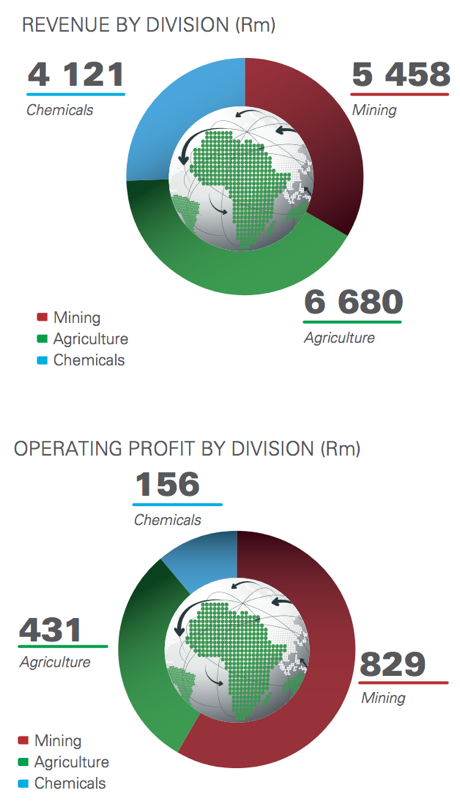

Omnia released their annual report for the year to end 2014 yesterday, you can download it and have a read: Omnia Holdings Limited integrated annual report. Not just any read I guess, the quality of our annual reports I find are quite good by global standards. If you needed a refresher of what the group sells and where they make their profits, from a revenue point of view it is pretty well separated into three parts revenue wise, but the profits are more heavily weighted to mining.

The piece titled Explosive farming that we wrote when the company had results a couple of weeks back cover the numbers in some detail and end of course with the conclusion that you should buy this company. The annual report talks about the importance of having commissioned another nitric acid plant, to meet the demand side:

"This has significantly improved security of supply to the mining and agricultural market, reduced Omnia's cost of inputs and allows the Group to more aggressively broaden its product range and expand into African markets."

Some of the reasons supporting the investment in Omnia as a result of strong demand for minerals across the continent, as well as being able to extract full value out of the under-utilised farming land are points well made.

Three paragraphs stand out for me with regards to the agricultural division and why fertiliser is increasingly important:

"The FAO (Food and Agriculture Organisation of the UN) states that by 2050, world food production will have to rise by 70%. Approximately 80% of this increase is projected to result from increases in yield and cropping intensity in developing countries."

And then more to the point about the fact that Omnia has a key role to play in feeding the continent:

"In Africa, farmers only apply 10% of the global average application rate of fertilizer per hectare. Omnia's agronomic expertise is extensive and supports optimal fertilization, while our knowledge of Africa's agricultural environment enables us to provide practical and sustainable solutions for food security issues."

And then lastly, for the agricultural division, in the 2015 outlook segment:

"Sub-Saharan Africa holds more than 60% of the globally unutilised arable land and investment in African agriculture can be expected to grow substantially during the next decade."

It is always fun to read the annual report, to see that the company is on track with your investment thesis. The company ticks all the right boxes and the agricultural element is exciting, the mining business is doing well currently and should continue to grow. The chemicals business margins are growing, and compliments the other businesses well. We continue to recommend Omnia as a solid investment to supplement the resources investments that we recommend.