Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Omnia reported numbers yesterday morning for the full year to March. Firstly, what is it that this company does? Well, they have been around for a long time, 61 years and are providers of fertilisers, explosives and chemicals to not only local customers, but to around half of the continent we live on, Africa as well as to Brazil and Australasia. Mostly it is mine related activities in Western Africa, ironically only agriculture in Australia, predictably New Zealand and Brazil. South of the equator on our continent Omnia's three businesses are represented from Angola to Tanzania. Omnia's rest of Africa business has been represented for around one quarter of a century.

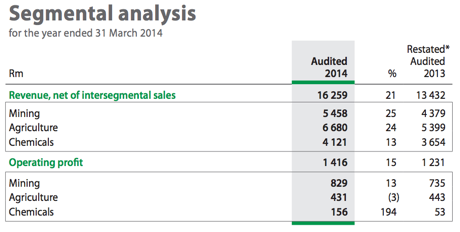

Let us look at the record numbers straight away in an analysis of their three businesses, the mining business, which is not only explosives, but chemicals too and then their agriculture business, fertilisers and lastly, the least exciting business, the chemicals one.

So that gives you a pretty good idea of how the business ticks, revenue grew 21 percent to 16.3 billion Rand (a record) thanks to both volume and price increases in their agricultural and mining divisions and partly due to price increases in their chemicals business. Which tells me of course that the chemicals business has been stodgy.

It is a massive business, the chemicals one, it offers 10 thousand products to around 6 thousand customers. But yet it remains a laggard. In the 2013 annual report the following was said: Recent discussions with the dti have highlighted that government realises that the chemical sector in South Africa is not growing in line with global trends. Several reasons have been identified and discussions to try and lift the sector out of its moribund state have been initiated. While these discussions have merit, significant industry growth will require a national gas network to be developed to help contain energy costs, as well as significantly increased mining activity with a much greater degree of mineral beneficiation.

The growth of the chemicals business depends on whether or not shale gas extraction takes place here locally, or whether or not they are to sell significantly more volumes across the continent, through their East African businesses. But, as you can clearly see, this is not the most important business to Omnia right now, but has the potential to be a serious profit contributor to the overall group. A positive for the chemicals division is a massive jump in their operating margins, but still, at 3.8 percent it is low.

For now however, the most profitable part of the Omnia stable is their mining business, which is twice as profitable as their agriculture business. Their mining business provides bulk explosives, mostly for opencast mining. Again when I refer to their annual report from 2013, they have this to say: "South Africa's underground gold and platinum mining sectors are in the doldrums and are proving to be unprofitable markets for explosives, as price pressure and lower volumes reduce their attraction." And as such, in their mining division back home, Omnia are really well placed. And across the rest of the continent?

In West Africa the company is more active than before, I would have to presume that surface mining operations would be mostly confined to non ferrous metals. I am making presumptions here. In other words, read iron ore. Now as you may know, it (iron ore) is one of the worst performing metal prices this year. The more important question is, unlike BHP Billiton whose profits depend on the iron ore price (an example), for Omnia it would depend on the volumes that BHP Billiton were to move. For instance, you would recall the piece that Michael wrote in February titled Earnings up 24% and waste up 26%.

Michael wrote at the time that "The trend of having to remove more waste to get to the ore is expected to continue, with output in 2016 expected to be 19% higher than 2013, but waste is expected to grow by 61% over the same period." So quite simply, who does this actually benefit? Clearly it becomes more costly per produced ton to move more waste, but someone, and in this case the explosives producer would be the winner. One of a few winners of course. The price of iron ore and the profitability of the outfit and more importantly increased steel consumption matters the most. And that trend is set to continue. So you would think that the mining space, explosives at least the kind that Omnia sell (and the associated chemicals) is a good growth business, right now.

And then on to the most exciting part of the business, at least for me, fertiliser. A certain economist Thomas Malthus published a piece which agricultural production would not be able to keep pace with growing populations, in particular because they (the urban populations) were growing too quickly and traditional methods of agricultural production would not have kept pace. Of course what Malthus failed to see was innovation coupled with profit motives. And that of course was around the time that industrialisation was taking place across much of Europe. On the Wikipedia website, under the fertiliser segment, the suggestion is that HALF of the people on earth are fed as a result of synthetic nitrogen fertilizer use.

The Haber-Bosch process, for which Fritz Haber, the German chemist who won a Chemistry Nobel prize (1918) for his development of producing synthetic ammonia (patented in 1908), is responsible for all of this, and is a process that Omnia uses in production of ammonia. Ammonia is then used as one of the inputs into both fertiliser and explosives. So it was very important for Omnia to have built their nitric acid and ammonium nitrate plant (all of 1.4 billion Rand investment) and finished it at a cheaper cost than international norms, back in March of 2012. The company raised money by asking their shareholders to pony up 1 billion Rand, by issuing 20 million new shares at 50 Rand each. And back then, that was 42.3282 shares per 100 existing. Those shareholders have been handsomely rewarded with a fabulous investment from management in their own business.

You do not need to understand the Haber-Bosch process or worry about Malthus' predictions, what you do need to pay careful attention to is that Africa has much of the worlds arable (and fertile) land and there are going to be more mouths to feed by 2050. And as such, better methods and more fertiliser will be used across much of our continent in the coming decades. Also, water pollution and water usage (Omnia has water cleaning technology) will become more important and is definitely not a priority on our continent yet. As an investment, this company is in the right space right now. Mineral demand and agricultural development across the continent continues at a fast pace.

At 223.15 Rand a share, on historic headline earnings (to March) per share of 14.28 Rand, a dividend for the full year of 4.4 Rand means that the company trades on 15.6 times earnings and a yield of 1.9 percent. Before dividends tax. What is also important to note on the dividend front is that the company has serviced much of their debt and remains unguarded, meaning that they could make a chunky acquisition soon. Rod Humphris, the CEO is solid, the management team is steady, the company is a good one. In time their shareholders may be more rewarded with higher dividends, we continue to buy Omnia.