Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday Kumba Iron Ore released their full year results. The highlights were that revenue is up 20%, headline earnings are up 24% to 4808c per share and the full year dividend is up 26.3% to 4004c per share.

The breakdown of Kumba's production at the moment has Sishen contributing 73% and their Kolomela mine contributes 25%, so what happens at Sishen is important for the company as a whole (and by extension is important to Anglo America who own 69.7% of Kumba).

The worrying part of the results was that Sishen's production was down 8% and the waste cleared by the mine up 26%. The trend of having to remove more waste to get to the ore is expected to continue, with output in 2016 expected to be 19% higher than 2013, but waste is expected to grow by 61% over the same period. Below is a cross section of the Sishen mine, which shows the increasing amount of waste that has to be removed to get to the ore. The other point to note is the thickness of the ore seams, they are getting thinner, which means they are going to be moving more waste for less ore.

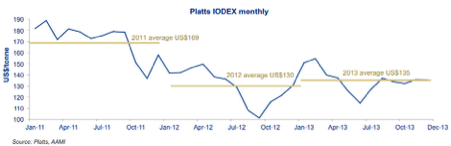

The most concerning part of Kumba Iron ore lies in the product that they sell which has a very volatile price. See the graph below showing the change in the price over the last 3 years, the range has been between 100 and 190 per tonne, which is huge! In 2006 the price was only around $30 a tonne, where will it be in 5 years time (and by extension where will Kumba be)? For the coming year analysts are expecting prices to be under further pressure, with more supply coming online from mines in Brazil and Australia.

If you currently own the share, would I sell it? Probably not. I would use the high dividend pay-out, about 9% on today's prices to invest in other companies. For me it wouldn't be worth selling the stock at the current time, and incur the capital gains tax and brokerage costs. I wouldn't be a buyer of the stock though, if the stock market closes today and didn't open again in 7 years, would you feel comfortable in the value of Kumba?