Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Naspers bucked the market yesterday, gaining 2.6 percent, but a whole lot more at one stage, nearly four percent up, and nearly regaining all of the losses in the session prior. Just shy of 843 Rand a share at the highs, the stock closed at 82882. The all time high is 847 Rand, from a few sessions ago. The stock also plunged 4.7 percent the session prior to reach an intraday low of just over 802 ZAR, so the ride has been very wild over the last few days.

I actually had started a piece from the prior session, but scrapped it because time was getting the better of me. How often does that happen? All the time sadly, again it doesn't matter, here it is. Remember that Naspers own 34.9 percent of Tencent. So hold this little piece handy for yourself to get to a value of that stake. In fact you will remember that around two weeks ago I wrote about why Naspers' share price had been up so much in a post titled: Why is Naspers up so much?

There is inside of that, the calculation of the Naspers stake which is as follows.

Market cap of Tencent today: 683.48 billion Hong Kong Dollars.

Hong Kong Dollar to the South African Rand today = 1.2891

Multiply 0.349 by Tencent market cap by 1.2891 = 307.49 billion ZAR. That is of course today. The closing market capitalisation of Naspers last evening was 344.6 billion ZAR. So, that tells me that Mr. Market gives the rest of the business a 37 billion ZAR valuation. But that is probably not true, what is more likely is that the local market investment community in their infinite wisdom have decided to probably discount the Tencent stake.

Because surely the DStv business, which at the last year full number stage, revenues from that business were 30.2 billion ZAR, with "trading profits" of 7.559 billion Rand. Half of their total profits come from their pay TV business, that is growing in the high teens. The question then arises, what would you pay for that standalone business? 10-15 times earnings? Somewhere around 100 billion Rand. And forget for a second that Naspers still has loads of potential in all their other stakes around the non English speaking world, internet assets that are worth a bomb more than the market values it at.

So do South African's undervalue the company because they do not believe the valuations that the folks give to Tencent in China? Who are we to believe that it should be any different there, than it is here? Well, it is very lucky for all of us that Byron has decided to explore Tencent a little more in his daily beats. Turn the volume up:

As Sasha alluded to earlier, the Tecent price is extremely important for the Naspers share price and to properly analyze Naspers you need to properly analyze Tencent. They released results a few days ago and I had a closer look. It is an amazing business that can be complicated to understand because we are not consumers of the products ourselves and due to the language barrier, it is almost impossible to become a consumer. Fortunately the financial statements have an English version, let's try and understand how the business manages to do so well.

Firstly, let's clarify what they do. Here is how they explain themselves in the report: "Tencent uses technology to enrich the lives of Internet users. Every day, hundreds of millions of people communicate, share experiences, consume information, seek entertainment, and shop online through our integrated platforms. Our diversified services include QQ, Weixin and WeChat for communications; Qzone for social networking; QQ Game Platform for online games; QQ.com for information; as well as our eCommerce open platform."

To gain a perspective of the numbers we are dealing with here, these are the subscriber bases for these individual services. Monthly Average Users (MAU) for QQ reached 818.5 million, 477.6 million of those from smartphones. This is an instant messaging service similar to Mixit but is also used on a PC. Weixin and WeChat (they are the same thing) has 235.8 million users. This is a smartphone only chat service similar to Whatsapp. Qzone which is a Facebook type social network has 626.4 million subscribers with huge smartphone penetration, 357 million subscribers access Qzone through their phone. QQ.com is a media platform where people can blog, share information and videos.

Of course a lot of these users overlap but you get the picture. So how do Tencent make money? This is the interesting part. They call it Value Added Services (VAS) which is responsible for 75% of the company's revenues. This includes club memberships, avatars, personal spaces and communities, online music, dating services, applications and online gaming. Users are clearly happy to pay for these extra services.

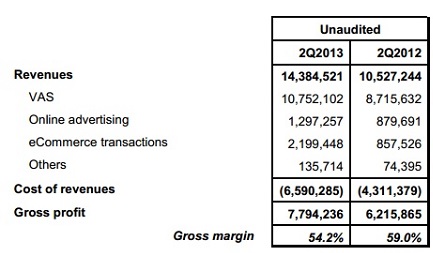

The other two areas where they make money are online advertising and eCommerce transactions. Here is an image of their revenue makeup for the half year and where the growth is coming from. It is stated in Renminbi (trades at 1.64 to the Rand). Look at that amazing growth from the eCommerce division!

The growth is phenomenal and so is the gross margin. But why are margins declining and why was the share price so badly down on the day? WeChat is their next big thing and they are trying to introduce it outside of China in the likes of South East Asia and South America. They have hence stepped up the marketing activity which has been costly. I have nothing against margin compression right now for future profitability. It is risky, especially trying to infiltrate western markets but they have the cash to go for it.

Yes it trades on a forward PE of 33 but you can see why, those numbers are huge and the potential to further monetise that subscriber base is enticing. What really excites me is the fantastic response they have received from the smartphone revolution. I'd say not even they expected such a massive adoption of these devices. I guess both services complement each other. Being able to use Tencent services on your smartphone makes the experience that much better and worthwhile. I am far from concerned about the valuations of this company and the same therefore goes for Naspers.