I was asked yesterday as to why it was that Naspers has had such a run, why the stock price was up so much. I thought for a while and then applied myself and came up with this answer:

To me it is simple, a Facebook re-rating over the last 8 trading sessions must have a lot to do with it. Plus LinkedIn. The "quality" internet assets have been rerated.

Since the 25th of June Tencent is up a whopping 33.3 percent! Over the last month alone Tencent is up 20.23 percent in Hong Kong.

On a simple NAV basis that has added 51.15 billion ZAR (570bn HKD @ 308.4 on the 25th of June to 685.98bn HKD @ 370.8 on the 5 August = 115.4 bn HKD difference * 1.2697 (exchange rate) = 146.57bn ZAR * 34.9% stake = 51.15bn ZAR)

Pretty easy to understand, methinks!!

25 June, Naspers = 688 ZAR, today (5 August) = 815 ZAR. Shares in issue = 415 million shares. 127 ZAR*415 million = 52.7 billion ZAR.

Sounds about right!!!

The market I guess was working properly there. And Facebook, if you had not noticed had been through their listing price of last May. In early September the stock traded as low as 17.55. Just under a year ago there is someone who is looking at the price at 39.19 and asking themselves, why oh why did I sell that one? Because at the time there were anxieties over whether the company could monetize mobile. And yes, by the time the company reports their next quarter you might see advertising through their mobile channels at nearly half of all revenues. The company trades on a forward multiple of 80. That is crazy. But that shrinks quickly over the coming years as the business starts to be more and more profitable.

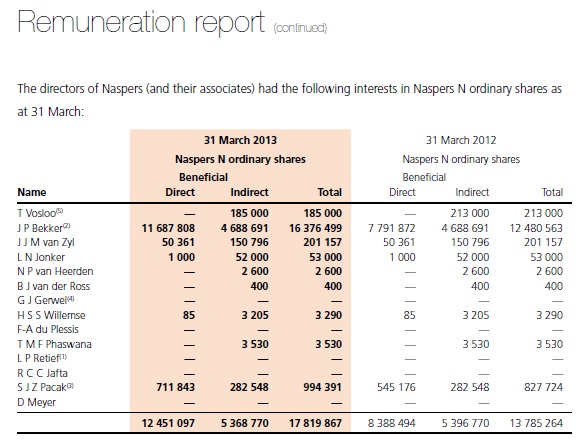

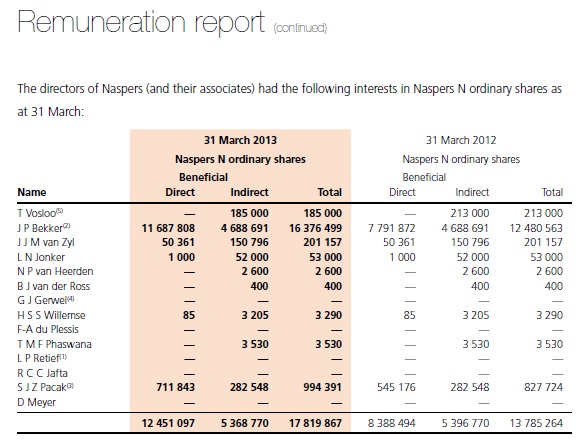

But back to the other issue at heart here too, the remuneration of Koos Bekker in Naspers N stock. I was asked about that too, and equally I am going to share my answer with you:

In the annual report (page 117) it says:

"The chief executive, Mr J P Bekker, does not earn any remuneration from the group. In particular no salary, bonus, car scheme, medical or pension contributions of any nature are payable. No other remuneration is paid to the executive directors. Remuneration is earned for services rendered in connection with the carrying on of the affairs of the business in the company. Interests in group share-based incentive schemes are set out below."

Also, it makes it clear:

"Mr J P Bekker has an indirect 25% interest in Wheatfields 221 Proprietary Limited, which controls 168 605 Naspers Beleggings (RF) Beperk ordinary shares, 16 860 500 Keeromstraat 30 Beleggings (RF) Beperk ordinary shares and 133 350 Naspers A shares."

But I guess you are referring to the shares payment arrangement, the 3.9 million shares that are to be paid in the years three, four and five of his current contract:

He agreed, the board agreed and shareholders no doubt ratified the payments in shares. When the share price was much lower, that stake was worth a whole lot less.

Total shares in issue are around 415.8 million shares, he is effectively a 4 percent shareholder. Good to have the chiefs own holdings aligned with yours, it is not altogether his fault that the stock price has gone bananas and through the roof. That is no doubt why he structured the deal that way!!

Not sure what to think further.........

As shareholders we are glad that he has his interests aligned with our own. Shareholders must remember that in large part it was and is his visionary thinking that made them a fortune, so far of course.