Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Jeff Bezos announced another stellar year of growth for Amazon.com on Thursday. As Sasha wrote yesterday, the market was expecting more. Headlines on Friday morning were along the lines of "Amazon disappoints". I think sometimes people get too focused on the expectations and lose sight of the bigger picture. Full year revenues grew by 20% to $107 billion, putting them into an exclusive club of companies. To put their revenue growth into perspective, the revenue growth of $18 billion last year was more than the total revenue of Visa for 2015.

Thanks to the 122% growth in net income, the company now only trades on a P/E ratio of 460! Based on that metric the stock is wildly expensive but having a look at the following graph, it is clear that all the capital expenditure is paying off and owning this company is a long term play.

You will find more statistics at Statista

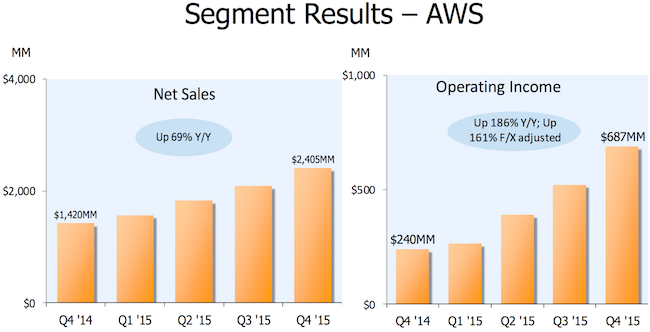

The big profit driver is still Amazon Web Services (AWS), a part of the company that many people forget is there. Even though it only contributes 7% of the revenues it is the bulk of the profit. AWS is the profit centre that allows the e-commerce division to have very thin margins, which brings in customers and has allowed amazon.com to be the dominant online retailer.

Amazon Prime, is where Amazon locks in customers and once they are locked in as a Prime customer, they spend more. Prime membership is up 51% for the year. The service that is putting daylight between amazon.com and their rivals is Prime Now. There are 25 cities around the world where you can sign up for Prime Now, which means that your goods will be delivered with in an hour of you ordering them!

For the quarter ahead the company expects to grow net sales by between 17-28%, all the top line growth is forecast to trickle down to the bottom line. The 2017 forward P/E ratio is currently sitting at 62, which is still very high but does highlight how quickly profits can grow and the P/E unwind to levels more comparable to traditional businesses. There is still huge amounts of growth left in the amazon.com tank and will probably be competing soon for Googles newly acquired crown of "world's largest company". Buy