In recent months we've been buying shares of Booking Holdings for clients. As you probably know, it's the world's largest online travel agent. Now that Covid is behind us, demand for local and overseas travel is through the roof.

Booking connects users to 31 million accommodation options in over 220 countries, and sells more than 3.5 million room nights every single day. There are also numerous services for car rentals, flights and travel packages. It spends a ton of money on Google, to appear when users search for 'hotels in [insert city name]'.

It's not just a platform for end-users. It has a sophisticated online engine that is used by their hotel partners to flag room availability and update prices.

The business has an interesting backstory. It was founded in 1996 by a Dutchman called Geert-Jan Bruinsma at the University of Twente in Enschede, Netherlands. It was a pan-European operation from the start.

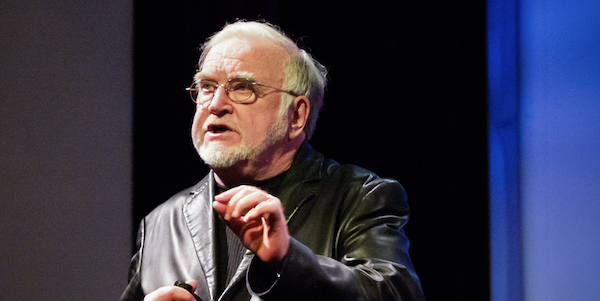

A US-based online travel operator, Priceline, had an ambitious head of mergers and acquisitions called Glenn Fogel (pictured here) who is now the CEO of Booking Holdings. Fogel went on a buying spree, acquiring ActiveHotels.com in 2004 and Booking.com for $133m in 2005. The whole group was renamed Booking in 2018.

Gross bookings are approaching $200 billion per year, and they capture about 10% of that flow as revenue. Both of those metrics are rising at around 10% year-on-year.

This is a good one, you should consider adding some Booking shares to your Vestact portfolio.