Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Tuesday we received full year and fourth quarter results from Cerner, one of our favoured healthcare stocks listed in New York. I have explained what these guys do before but this video clip titled What is Cerner Health does a great job. It's short and paints a good picture of what this business does. For a local example think of Discovery's Vitality product. But it goes further, it integrates all this info with doctors, nurses, chemists and medical devices. Tracking ones healthcare history, their fitness and wellness as well as their finances concerning healthcare spend. Their catch phrase "Health care is too important to stay the same" certainly inspires. The company services 18 000 facilities in 30 countries.

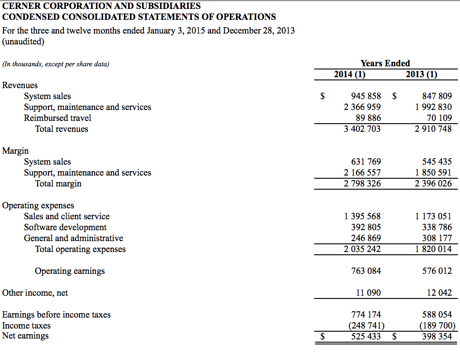

Numbers. Bookings in the fourth quarter were up 5 percent to $1.16bn. Bookings for the full year were up 13% to $4.25bn. Bookings represent the order book. Revenues for the full year came in at $3.4bn which is up 17% from 2013. Net earnings for the full year came in $576 million which equated to $1.65 per share. Below I have hacked their income statement from the presentation just to give you a feel of where the business makes and spends their money.

Earnings for 2015 are expected to come in at $2.13 which would mean growth of 29%. They did make an acquisition of Siemens health which will be earnings enhancing. More on that later. The share trades at $67.7 or 31 times 2015 earnings. It's expensive but it's growing fast. They bought that Siemens business for $1.3bn cash and have almost zero debt. You'd expect more earnings enhancing acquisitions as the sector consolidates.

The business sits in a sweet spot and I can only imagine the blue sky for selling their product globally. The potential efficiencies they can create in such a vital service is huge. And I am pretty sure governments around the world will take notice. Take the UK's NHS for example. So many publicised inefficiencies within this system could be sorted by implementing Cerners products. Locally I'd love for Mediclinic, LifeHealth and Netcare to take these products on. Filling in forms is a huge mission, imagine how difficult it is for a doctor to get hold of your history, all on paper.

The Siemens acquisition was also well received. The business focuses more on labs and imaging. This will synchronise the information gathered at the testing labs directly with the doctor who needs that info. How many lives can be saved because of a speedy response time to a diagnosis. The options are endless. We continue to add.