Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday one of our recommend stocks Omnia released 6 month results for the period ending 30 September. These numbers were not well received by the market and the stock fell over 11%. Lets look at the structure of this chemicals business then delve into the numbers.

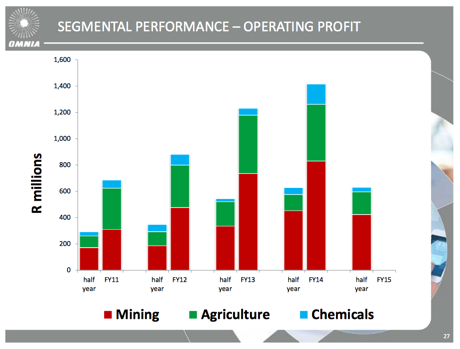

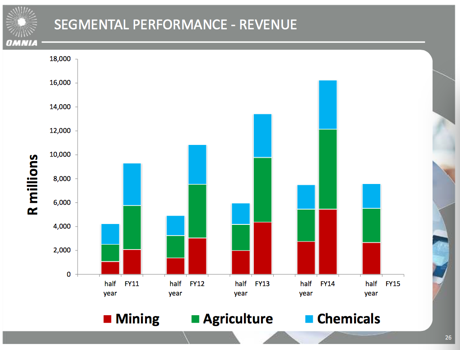

Ultimately it is three divisions; Mining explosives, fertilisers and chemicals. Here are 2 tables hacked from the presentation which shows you the contribution from each division.

As you can see Mining is the biggest profit contributor, with agriculture not far off. Chemicals is a big revenue contributor but adds very little to profits. We can also see here that the second half of the year is much bigger than the first, especially for fertilisers which is of course seasonal.

Revenues increased by 1.1% to R7.6bn, profits for the period decreased 4.7% to R404 million, operating margins remained the same at 8.8% and the dividend increased 2.7% to 190c. After all was said and done basic earnings per share were down 4.9% to 606c. The share currently trades at R194.80 but its hard to annualise this number because as mentioned above the second half is much bigger. Lets assume the company makes R14 a share for the full year, (down 6.5% from last year) the stock trades on 13.9 times earnings. Sounds fair for a business of this nature. Lets look at the different operations.

Mining. As you can imagine the division had a tough period. Revenue was down 2.7% and profits were down 6.4%. Commodity prices have slumped which means your smaller producers get pushed out the market completely and stop mining. The strikes on the platinum belt also did not help. It's not all doom and gloom. Omnia have a massive presence throughout Africa, especially in West Africa where mining spend is booming compared to SA. They are also more exposed to opencast mining which is less reliant on labour.

Agriculture. Africa has 60% of the worlds uncultivated arable land. Many farms are extremely inefficient. The room to grow here is huge. However certain macro factors have gone against Omnia. Ammonia is an input and due to a lack of global supply the price for the product has increased. This compared to the final demand for fertiliser which has remained stable means that Omnia have to absorb this price increase. We have also seen a decrease in maize and wheat prices which of course means less planting. The rains have come late this year so Omnia expect a much better second half. Revenues increased 5.2% and profits increased 40% (they had once off production costs last year).

Chemicals. This division is geared towards the South African manufacturing sector which is facing many challenges as we all know. Revenues increased 1% and profits were down 34%. Strikes and Eskom related issues have put pressure on the companies who demand Omnia's products. This division contributed 5.5% to overall profits.

Conclusion. It is tough, especially for their biggest profit driver in mining explosives. But this business is well managed, has a great infrastructure set up and should benefit from many fast growing sub-Saharan countries where they operate. Operations in China, Australia and Brazil give them some diversity. I continue to like this business but it is going to be a choppy ride.