Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received 4th quarter and full year results from Johnson and Johnson. Before we delve into the numbers let's see what the share price has done. In the last year the share is up 28%, in the last 2 years it is up 54%. It has been a good performer to say the least, especially when you consider the size of the business and the risk you would be taking when buying this stock. I'd say the reward has far exceeded the risk.

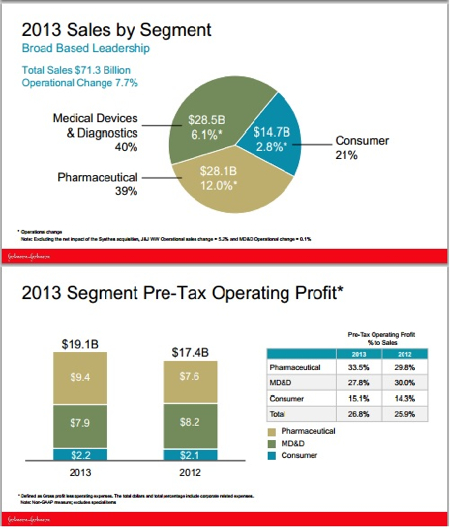

The pie graph below explains the company's business perfectly. As you can see it is broken up into three main divisions which as a collective managed grow sales by 7.7%. With some negative currency impacts revenue only grew by 6.1%. The Pharma business is still the most profitable and is certainly the gem of the company. In fact many analysts are calling for a company split so they can just invest in the Pharma side.

Medical devices have struggled slightly in terms of margins but that is because they are investing heavily in this division both organically and through acquisitions. The consumer business is still solid and even though the margins are tight, it is an important part of the business especially when targeting growth in developing markets.

Net earnings for the year came in at $13.8bn or $4.81 per share. Without the special items the earnings came in at $5.52 per share. Expectations for next year are around $5.85 which puts the stock on 16 times next year's earnings. For a massive company like this, growing earnings at a solid 6% a year, I'd say this reasonable.

I also saw some interesting comments in a WSJ article which looked at the effects on Medical companies from the US health care overhaul. Chief Executive Alex Gorsky said that this should push up the demand for their products as more people subscribe to the state medical insurance. The exact impact is not yet known yet though. On the other side of the spectrum however these big Pharma companies are expected to contribute to the insurance coverage. JNJ paid as much as $1bn to the fund last year. Here is the article titled Johnson & Johnson's Profit Jumps 37%.

Is still feel JNJ offers great exposure to one of our favourite themes, healthcare. You get instant diversification both by product and geographically. As developed nations get older demand for their products will increase. As developing nations get richer the same will apply. We are happy to add at these levels.