Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

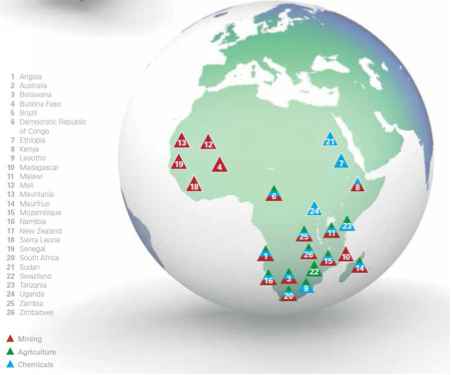

Omnia, the chemical manufacturing company came out with their 6 month results yesterday. As usual, I like to start with the company structure and operating reigns, so that you can have the big picture of the company when we talk about the smaller details. In their own words, "Omnia is a diversified provider of specialised chemical products and services used in the mining, agricultural and chemical sectors.". The mining sector sells mostly explosives, their agriculture division mostly sells fertiliser and the chemical division mostly sells domestic household chemicals. See below a map showing where they operate.

The highlights from the announcement were as follows:

- Revenue up 25.7% to R7.5 billion

- Profit for the period up 16.8% to R424 million

- Operating margin down from 9.1% to 8.4%

- Earnings per share up 16.7% to 637.0 cents per share

- Dividend up 23.3% to 185 cents per share

The mining division was their best performing for the period with revenue up 37%, compared to chemicals whose revenue increased by 15% with a stellar 130% increase in operating profit, and agriculture whose revenue was up 24% but operating profit dropped by 35%.

Mining and agriculture saw an increase in the average price of its products and an increase in the volumes sold, which is great because you want to be buying a growing company, and a company that can pass cost increases on. The chemicals business just saw an increase in its average price.

The reason for the drop in agricultures operating profit is because of what they call the unfavourable urea to ammonia ratio, which in layman terms means that ammonia is the product used to produce the fertiliser but fertiliser is priced according to the urea price. Other contribution factors was unrecovered plant overhead cost because the plant was shut down for longer than expected, and then they have introduced a lower margins wholesale business.

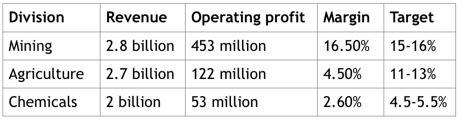

The 130% increase in operating profit from the chemicals division comes from bringing down overhead costs as a percentage of sales. The 130% increase is better than a slap in the face but comes off a very, very low base. The best breakdown of the company is comparing each division's revenue and operating profits.

The mining division has great margins, but the other two are below where you would want them, Chemical division does a lot of work to make only R53 million.

To reach their margin targets, they still have a lot of work to do, but I think that they will make progress through them keeping costs under control, while increasing sales volumes. In the agriculture division they will not have the cost of the unrecovered plant overhead, and they should see increased sales in their wholesale business, both should contribute to better margins.

My only concern about the company is their current margin levels, but not concerned enough not to own them. So why own Omnia? In Sasha's words' "They are a great Africa investment", and by that he means that they have a presence in large parts of Africa, and in sectors that should be growing. As Africa and the world grows, food becomes more important. The advantage of their business is that they are not directly exposed to the risks of fluctuating food prices and the threat of land grabs. The chemicals division is also in a sector that will grow as the middle class does, and in the African case, there is much growing still to be done in the middle class.