Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Omnia released results yesterday morning, this is for the full year to end 31 March, so we just got in here in the nick of time. For those of you who do not know what I am talking about, you have three months from closing your books to reporting results, otherwise you would face being suspended from the exchange. Who are Omnia and what do they do? Decent enough question. From their website: "Omnia is a diversified and specialist chemical services company which provides customised solutions in the chemical, mining and agricultural markets." So now you know, if you did not before.

The numbers. Revenue increased 6 percent to 9.4 billion ZAR, still below the 2009 levels of 11.1 billion ZAR. In fact the company to their credit sticks in that 2009 number, and you get three years worth of numbers. Profits of 451 million ZAR are a monster jump on last year, but 40 million ZAR below 2009. HEPS, that translates to 767 cents per share, no dividend. Reason being of course is that there was a 1 billion ZAR rights offer, you don't really want to ask shareholders for money and then give it back. On that basis I suspect that there might be a modest dividend this year, and perhaps the next, conditions in their major markets of course key. But I suspect that we will not see the awful business conditions past.

According to a graph in their results presentation Omnia Holdings Limited - Results presentation for the year ended 31 March 2011, South African manufacturing volumes are still only at levels seen in 2006. And we are still around 15 percent lower than the peaks in May 2008 (ironically when the JSE topped out).

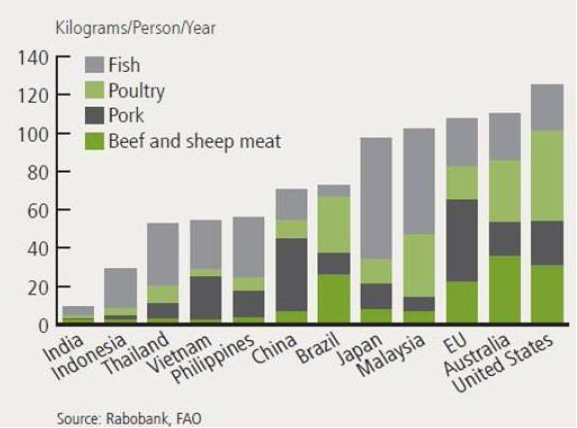

I really do like the fertilizer business. I believe that humans will have to come to terms with higher food prices, the total land mass of earth is not going to increase and there are more and more people on the planet. As I once heard, there is no plan B for humans on earth. There was quite a nice slide in the presentation titled: Per Capita Protein Consumption in Select Economies, I hacked it, check it out:

I quite like that graph, because the suggestion is that everyone is going to eat as much as the Americans. Hmmm... I doubt that really, in some cultures eating is not a hobby as it is in others. Nor is it a sport. OK, but Omnia seems to be OK, but nothing exciting. Operating (and net) profit margins have been steady over the last five years. Revenue has grown over 17 percent over the last five years. Sure they were rocked in 2009, but who wasn't. Sure they have undergone an enormous rights issue, but I suspect this company falls into the category of non exciting and steady. I see a sell and hold rating on the stock, but the stock still looks sort of cheap. Prefer Sasol really.