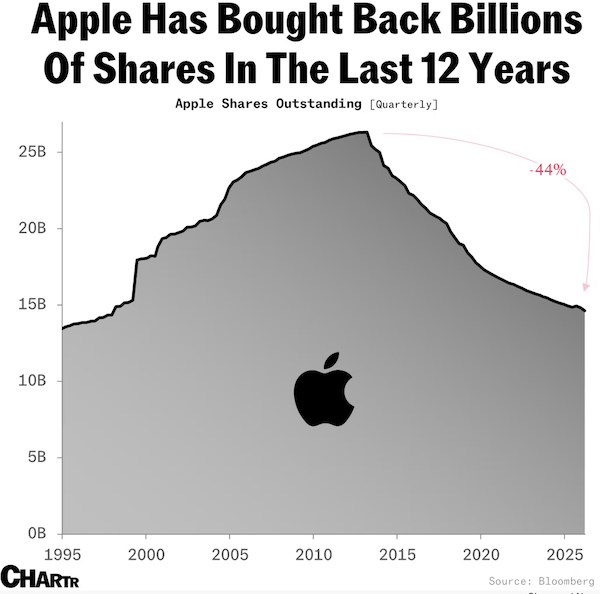

Apple has quietly pulled off one of the most impressive moves in corporate history. Since the early 2010s, Apple has reduced its outstanding share count by roughly 44% through aggressive share buybacks.

Fewer shares means that each remaining slice of the pie gets bigger without you lifting a finger, earnings per share go up, dividends stretch further, and your ownership stake quietly grows.

This isn't financial engineering for the sake of optics but a deliberate, disciplined capital allocation strategy. Apple isn't hoarding cash or making questionable acquisitions; it's buying back its own stock when it believes it offers the best return for shareholders.

As Charlie Munger put it, "If you're repurchasing shares below intrinsic value, you're doing your shareholders a favour." Apple has been doing us a solid for over a decade, and as long-term investors and shareholders, we should enjoy every minute of it.