Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Amazon had quarterly results out last week, and despite a very handsome beat on revenue and profits, its stock price fell sharply on the day (-8.3%). What gives, and should we be concerned?

Let's go back a step. We've owned Amazon shares in client portfolios since early 2011. We were attracted to its online sales platform, which was in the process of expanding massively, building many more distribution centres in North America, and going global. They were the leading e-commerce business back then, and they still are today.

Somewhere along the line they added a web hosting business, Amazon Web Services (AWS), selling spare server capacity to third parties. Unlike the retail operation, which has low margins, AWS has very fat margins. For the last decade, AWS has been the market leader, towering over Microsoft's Azure business and Google's Cloud unit.

For perspective, AWS generates $30.6 billion in quarterly revenue compared to Azure's $22.9 billion and Google Cloud's $12.5 billion, but has slower growth, for the moment. Microsoft's exclusive partnership with OpenAI has changed Azure from an "also ran" into the likely choice for AI startups.

The Amazon management team has responded by jacking up capital spending to $120┐billion in 2025, up from about $105┐billion previously. That means more Trainium┐2 chips (their in-house creation), more multi-gigawatt data centres, and agentic AI offerings across their hosting business.

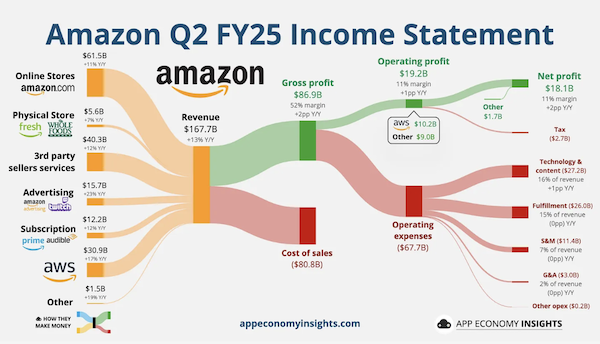

While we wait to see how that turns out, the rest of their business is doing brilliantly. The retail operation grew sales by 11%, the fastest rate since 2021. Prime Day set new records. Fulfilment and shipping for third parties also boomed. Advertising grew by 23%. Amazon Prime subscription revenue also stepped up by 12%. See the chart below, from App Economy Insights.

As ever, we are steady holders and buyers of quality companies. Amazon is most certainly in that category.