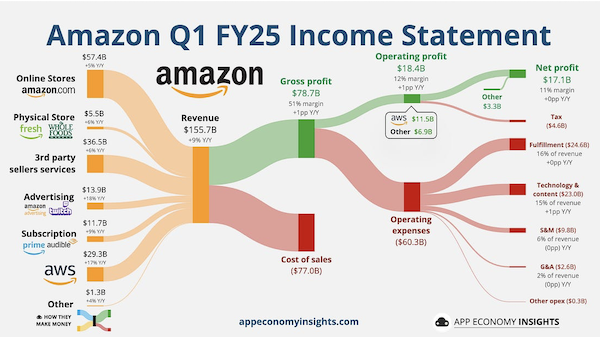

Last week, Amazon released some strong numbers for their first quarter. Revenues grew by 9% thanks to a solid push from AWS (+17%) and advertising (+18%). Online retail sales were up 5%.

As you can see from the Sankey diagram, the net profit column on the top right is not as thick as the other tech giants. That's because a large part of Amazon's business is retail, which naturally has low margins. The upside is that the online retail business allows for all the high-margin advertising and prime subscriptions. AWS was mostly just an incredibly successful side hustle.

Amazon made the news last week because there were rumours that they would specify on their site how much tariffs were increasing the prices of each item for sale. Cheeky. They backed down, but they do talk about it in the earnings guidance for the rest of the year. Thousands of Amazon sellers have already raised their prices, some by as much as 30%. Nothing impacts voters more than their wallets.

According to Synergy Research Group, AWS has a 29% share of the cloud services market. Microsoft Azure has 22% and Google Cloud has 12%. For the quarter, AWS lost 1 point to Azure, remember Microsoft's recent blowout cloud numbers? That's not too concerning, despite the ebbs and flows, all three manage to produce solid growth every quarter.

These were solid numbers from a fantastic company. Amazon is another core Vestact holding and will remain so for many years to come.