The first Vestact client bought Visa in November 2008 for $12.85 per share, it now trades at $275. That person has a sweet 2 033% return and has never sold a single share. Visa is the longest-standing position in our current portfolio and I do not see that changing anytime soon, especially after another solid earnings release on Tuesday.

Sales grew by 10%, net income grew by 10%, and earnings per share moved 20% higher to $2.51. The stock currently trades at about 24 times forward earnings with a dividend yield of 0.8%. All very solid. Visa does well when people are swiping their cards. Processed transactions grew by 11%, but more importantly, the high-margin cross-border volume increased by 16%.

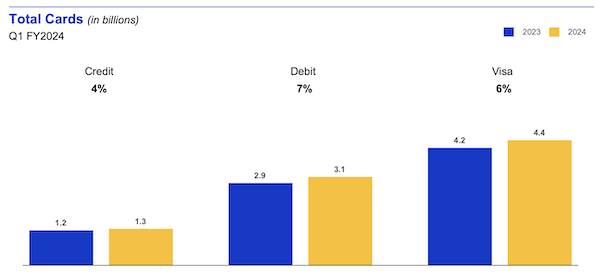

Visa currently has 4.4 billion cards in issue. Take a look at the image below which shows the year-on-year growth of credit cards and debit cards. That number is incredible. I wonder if that includes virtual cards too? Those have been growing fast lately, in my life anyhow.

There is not much to fault about this business, growing steadily, huge moat, the sector is robust and they benefit from network effects. We recommend Visa in all portfolios, whether you are young, retired, risk-averse or gung-ho. Just own it.