Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last night, Nvidia posted very good quarterly numbers, recording better-than-expected revenue, profit and forward guidance. The share price traded down 2% in after-hours trade, which is not a bad outcome after an epic rally in recent months.

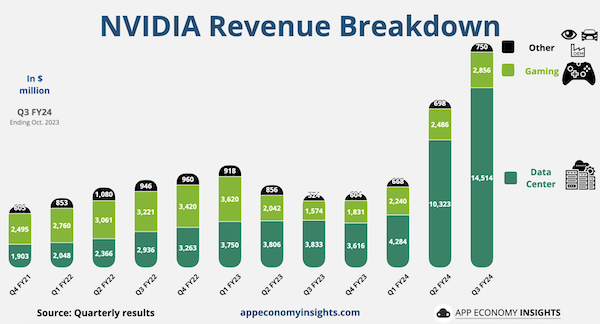

For the quarter, Nvidia reported revenue of $18.1 billion, an increase of 34% compared to the previous quarter and up 206% from a year ago! Costs only went up by 16% for the year, which is even more impressive. As a result, profits rose by an eye-popping 1 259% for the period. Now you can see why the company has enjoyed such a massive re-rating of its shares.

Comically, the quarterly dividend has stayed the same at a miserly $0.04 a share, putting the company on a dividend yield of only 0.03%. Their cash is better used to grow as quickly as possible.

Nvidia's gross margins have widened from 54% to 74%. For our non-accountant readers, this means that for every $100 in sales, only $16 goes towards the manufacturing costs of the chips and $74 is free to cover operating expenses and create profit for shareholders. With massive gross margins like that, you can understand why Tesla, Microsoft, Google and Amazon are trying to build their own chips, and reduce their reliance on Nvidia.

Looking ahead, the company expects sales of $20 billion for the next quarter. That's a nice 11% increase from current levels, and shows that the ban on selling chips to China hasn't dented demand. Their product development teams are working flat out on even better hardware.

The market expects much more growth from Nvidia, as the company currently trades on a forward price to earnings ratio of 46. Nvidia is a relatively high-risk holding, but one that we are very happy to accumulate and hold in our portfolios.