Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The whole market was holding its breath for Nvidia's results out on Wednesday night. Artificial Intelligence (AI) has been a key driver of the recent market rally and Nvidia is the sector's "poster child". I am happy to report that the numbers smashed every expectation by a country mile.

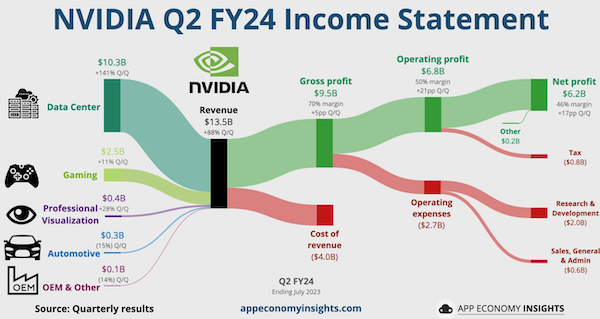

In May, Nvidia announced that it expected revenues for this quarter to grow by around 60%. Analysts were stunned and the share price rallied over 20% on the day. But could it really be done? Well, Wednesday night's numbers showed that those predictions were wrong, in fact they were far too low. Revenue for the group more than doubled from this time last year to $13.5 billion from $6.7 billion. Expectations were for a lofty $11 billion. That is a huge beat.

Data centre revenue was the star of the show, catapulting up to $10.3 billion from $3.8 billion last year. That division made up nearly 80% of group sales. As recently as last year, data centre and gaming revenues were the same size. The image below shows where the money was made.

The Nvidia share price rallied hard on the results, up by 8% at one point, but only finished up 0.1% yesterday, in a weak market. The historic PE multiple looks ludicrous at 244 times. But that does not factor in this kind of growth. According to Goldman Sachs estimates, Nvidia will more than quadruple earnings next year and then nearly double them again in 2025. This is not an unreasonable prediction, they made more money this quarter than they did the whole of last year. Based on those predictions the stock only trades on 28 times 2025 earnings.

So, it seems the market was right on this stock and the rally has been justified. Nvidia is at the forefront of chip design that is driving the AI revolution. Capital spending on data centres is through the roof, and chip demand exceeds supply.

Nvidia's designs are two years ahead of the competition, but that may change. Amazon, Apple and Tesla are all attempting to build their chips in-house and the likes of AMD are doing their best to catch up.

We are very happy to hold on to Nvidia. Whether it is AI, data centres, gaming, self-driving cars or professional visualisation, they are operating in the right spaces.