Apple released their fourth quarter earnings last week Thursday which missed expectations. This was only the third time in 20 years (80 quarterly reports) that Apple missed estimates, according to an analyst that I follow. That's a great track record! The share price actually rallied by 2.5% on Friday, against the tide as the Nasdaq dropped 1.6%.

Revenues came in at $117.1 billion versus $121.0 billion expected. Earnings came in at $1.88 per share versus expectations of $1.94.

There were three main reasons for the miss: supply chain constraints in China, currency headwinds and a tougher macro environment. Two of those are already looking better. China has opened up and the USD has weakened significantly since its peak late last year. The macro environment is always tough to predict but with a strong US labour market and a Chinese economy starting to normalise, there is light at the end of the tunnel.

Apple's guidance for 2023 looked favourable and the share price reacted positively.

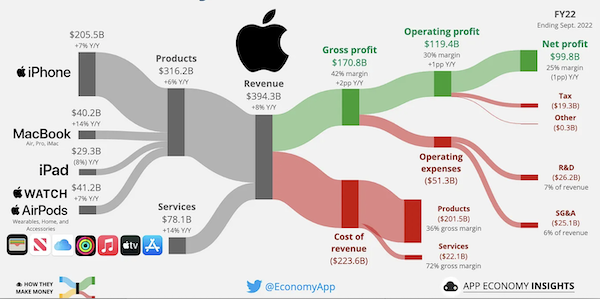

Apple really is the creme de la creme of companies. Take a look at the image below from App Economy Insights which breaks down Apple's annual results ending September 2022. The scale of the financial flows are just mind boggling. Apple made just under $100 billion in net profit last year.

Apple remains a must-own in all investment portfolios.