Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

b>Tesla is probably the world's most talked-about company, and they released fourth quarter results on Wednesday. This is always an exciting affair. Revenue for the quarter came in at $24 billion, up 33% year-on-year. This was 1% below the consensus view of analysts who cover the stock. Earnings per share came in at $1.19 which was 40% higher than last year, and 6c better than expectations.

There was, of course, a lot of focus on margins which are coming down due to vehicle price cuts. Tesla is not immune to the tough circumstances in the car market, where consumer demand has been hurt by higher interest rates. Automotive gross margins came in at 25.9%, the lowest figure in 5 quarters.

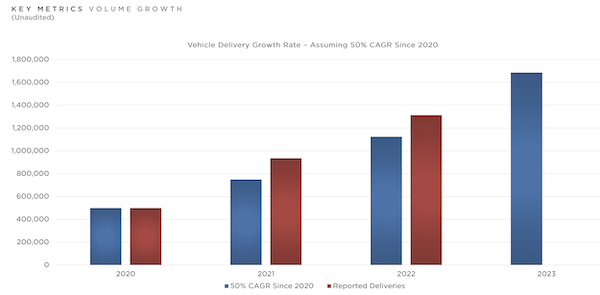

The market was pleased by the outlook for vehicle volumes, and Tesla stock closed up 11% on Thursday. The company commented that since they dropped prices they saw the strongest surge in orders in history. Elon Musk is obsessed with his stated goal of growing car production by 50% every year. Take a look at the image below, so far so good, but each year gets harder. To meet that target in 2023, they need to deliver over 1.6 million cars. Tesla forecasts they will push out 1.8 million, and some analysts have pencilled in an even higher number.

Earnings for next year are expected to come in at around $5 a share which puts them on a 29 times forward multiple. Tesla is a profitable business with strong cash flows and a very exciting future. The EV market is still in its infancy and Tesla leads the pack with the newest and best production facilities. Self-driving cars, energy utilities, robots and transport solutions provide extra upside potential. Tesla is Elon Musk's ticket to eternal greatness, I am confident he'll move on from Twitter soon and give it all the attention it deserves.