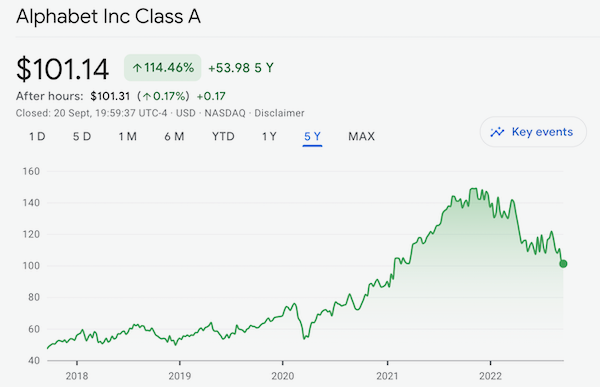

A few days ago Paul wrote about a time, some years ago, when the market underappreciated Apple. Then it enjoyed a massive rerating, and a lot of shareholders made good money. I feel like Alphabet (parent of Google and YouTube) is in the midst of a similar phase, oddly unloved.

The stock trades at 19 times this year's earnings. The company has net cash reserves of $125 billion. If you strip out that cash, the operating business trades on 17 times earnings. Alphabet is expected to grow earnings by 15% next year, so the stock trades at 14 times next year's earnings ex-cash. Net cash sits idle which is why you can exclude it from the valuations.

These are crazy low valuations for a company of Alphabet's quality that is growing earnings at a rate of 15% per annum. It is even below the average of the S&P 500, which currently trades on 19 times earnings. Fortunately, management feels the same way and are in the middle of a $70 billion share buyback program. When the market recovers I feel Alphabet will move significantly higher.