Google's parent company, Alphabet, reported a second-quarter top line that met analysts' expectations, showing how resilient the internet giant's business model is amid all the macroeconomic pressures that are weighing on the digital ads market. The shares rose as much as 5.7% in after-hours trading before cooling off to 4.9%.

Alphabet posted $69.7 billion second-quarter revenue, up 12.6% year-on-year, of which $40.7 billion was Search. Net income dropped by 13.6% to $16 billion. A special mention to YouTube, a division that generated $7.34 billion in ad revenue, holding its own against TikTok. Sales in the Google Cloud division rose 35.6% to $6.28 billion, but accelerated spending in the division led to losses of $858 million.

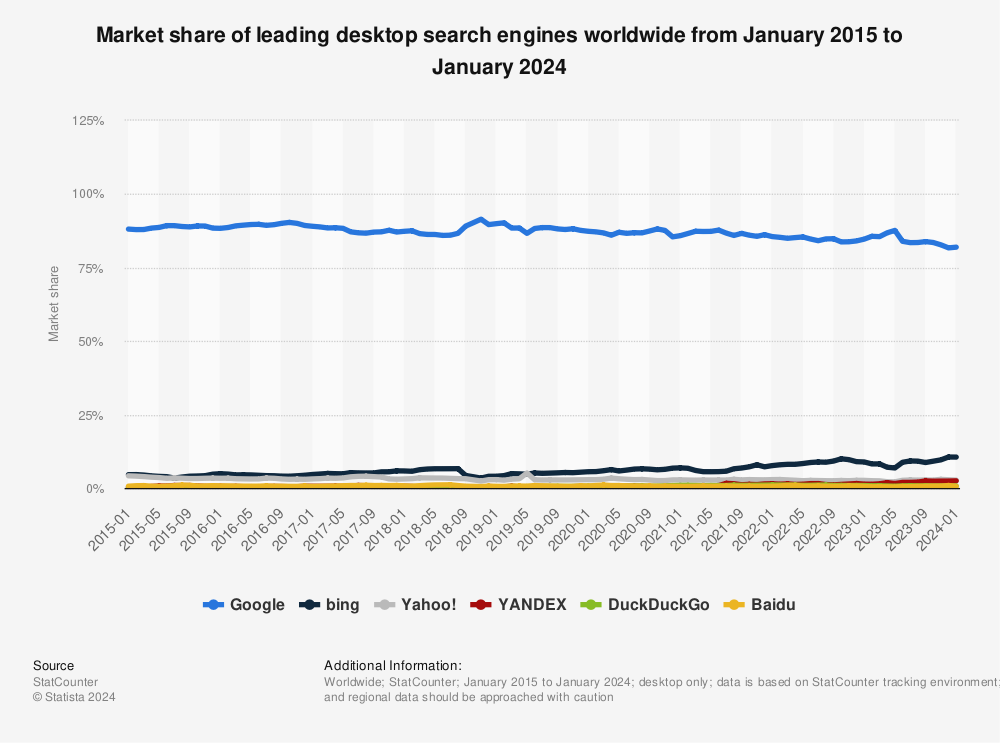

As of July 2022, online search engine Google accounted for nearly 83% of the global search market, while Bing sat at 9% and Yahoo was 2.55%. Ever since the introduction of Google Search in 1997, the worldwide market share of all search engines has been rather lopsided thanks to Google's dominance.

The crunch in marketing expenditure seems to be impacting the smaller social media companies more. Google's ad sales beat expectations, it seems that advertisers cannot justify cutting spend on the platform because of its dominance in search.

Google is still sitting on a $125 billion cash pile, which can easily help it weather any storm that may pass by. I like a business that has a strong business model with conservative management.

Find more statistics at Statista