Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week, Nvidia reported its fourth-quarter earnings that beat analysts' expectations and provided a strong outlook for this quarter thanks to massive demand. The chipmakers' revenues came in at $7.64 billion, up 53% year-on-year as Data Center sales rose by 71% and its core gaming business (50% of sales) showed no sign of slowing down.

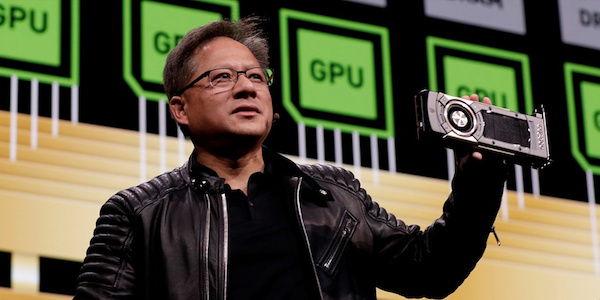

Nvidia was not immune to the current chip shortage, which increased lead times. However, demand for its chips has remained elevated throughout this period. Here's what CEO and co-founder Jensen Huang had to say on the issue: "We all have to recognise that the market size, our market footprint, is much larger than it used to be, we have to plan with a much larger horizon."

Nvidia relies on outsourced chip manufacturing, the above comments suggest that management may be thinking about vertically integrating its supply chain to reduce production time and improve supply predictability. This is not a foreign concept in the current environment where companies like Apple and Amazon have chartered ships/planes to cut the slack in their own supply chain.

The market seems to think that the $40 billion failed acquisition of ARM was a big disappointment. It is not all bad though, considering that two out of three big mergers have failed historically. Would this have been the exception? No one can know. Importantly Nvidia is still working with ARM in circuit designs for smartphones.

Nvidia's share price has come off by a fifth in 2022, giving long-term investors a second bite at this cherry, so use the opportunity to buy more!