Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Monday morning Prosus/Naspers released their six-month financial update. Naspers and Prosus are effectively the same entity, so for ease of reference, I'm going to only refer to Prosus here.

To be honest, the announcement was a bit of a non-event. The majority of Prosus's value sits in listed entities like Tencent, Delivery Hero, and Trip.com, so it is very easy to know the value of the overall company.

As you may know, their current stake in Tencent is worth more than their own market capitalisation, making everything else a rounding error. As far as Prosus's share price is concerned, the change in the Tencent share price on Monday was far more important than this announcement.

Prosus trades at a wide discount to the aggregate value of its underlying assets. That discount has gotten wider since the complicated and expensive transaction management forced through earlier this year. It might take years, but we feel that management will find a way to significantly reduce the discount and unlock massive value. Until then, Prosus is using the current deep discount as an opportunity to buy back as many shares as it can.

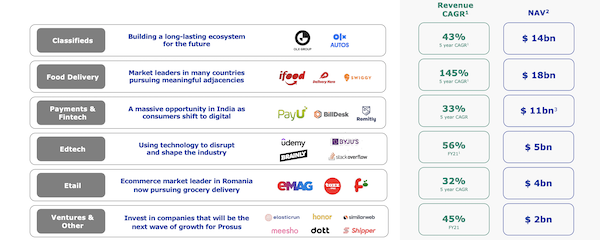

Management estimates that the value of all their investments, other than Tencent, is $49 billion. That's a $10 billion increase in value over the last six months. They feel that these assets could be worth $100 billion by the end of 2025, which would make them more relevant compared to the Tencent stake which is currently worth $176 billion. Prosus has a market cap of around $174 billion.

Thanks to a growing Tencent dividend and the cash-positive classifieds business, Prosus has been able to invest heavily in new companies and to allow some of their emerging businesses to run at bigger losses. The losses are acceptable as long as there is strong revenue growth, which is what we are seeing.

Prosus is still all about the moves in Tencent, but hopefully, in a few years, Tencent will be a much smaller part of the overall operation.