I was supposed to report to you on Nvidia's second-quarter results last month. Michael allocates each of us a list of companies to comment on each earnings season, and I dragged my heels, until now.

Sorry about that. For the record, Nvidia's results were very good (sales up 68% year-over-year) and the share price has kept moving higher.

Here are the highlights: (1) Revenue: $6.5 billion versus $6.3 billion expected. (2) Earnings per share: $1.04 versus $1.01 expected. (3) Data Centre sales: $2.4 billion versus $2.3 billion expected. (4) Gaming sales: $3.1 billion versus $2.9 billion expected.

One extra point to note please. Nvidia is still battling to close a transaction to buy UK-based chip designer ARM for $40 billion. The deal was announced in September 2020, but still hinges on approval by global regulators, and is still up in the air. We like the stock, regardless of whether that purchase goes ahead.

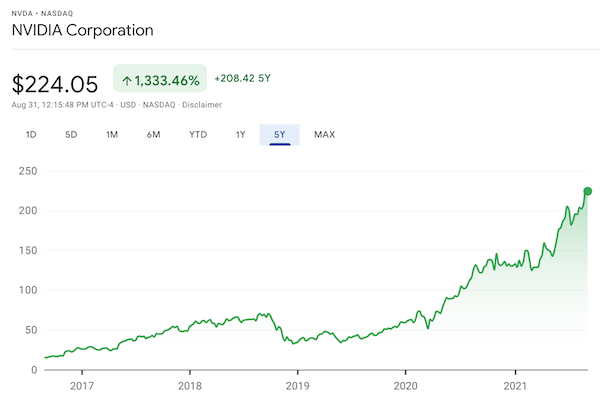

Just take a look at the 5-year share price chart below. What a winner!