You may have noticed that many big companies are not generous dividend payers these days. A few, like Amgen and Johnson & Johnson still dish out quarterly dividends at a yield above 2.5% per annum, but they are the exception. Others like Amazon, Google, Facebook and Tesla pay nothing at all.

One of the reasons that dividends have fallen out of favour is that many cash-flush corporations do share buybacks instead, because it is more tax effective. That's fine by me. Fewer shares in issue means more profits for the remaining holders, such as ourselves.

Some companies, like Apple, do both. Apple's dividend yield is only 0.6%, which seems stingy, especially since their massive revenue, at glorious margins, results in a torrent of free cash.

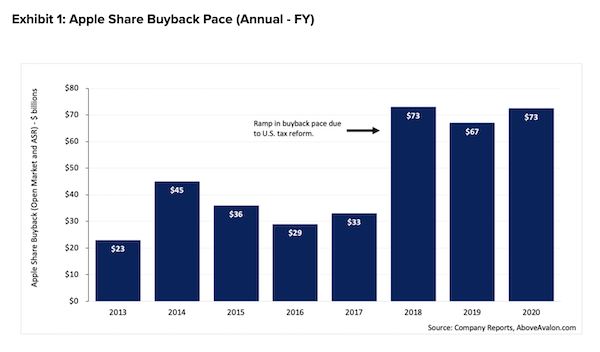

Apple began buying back shares in 2012. That was despite spending a ton on new manufacturing facilities and future product development. They kicked off at a run rate of about $40 billion a year, and then picked it up to around $70 billion per year after 2017. See the chart below.

According to Above Avalon, Apple has spent $380 billion to buy back 10.6 billion shares at an average price of $35.80 per share since 2013. That's amazing, they now trade at around $150 per share! Read more about the programme here.