Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

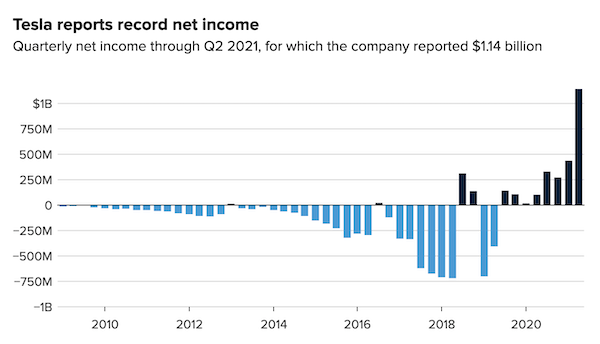

Tesla reported its eighth consecutive quarterly profit last night, cracking through $1 billion in net income. That's 10 times the profit that they made a year ago. Take a look at the CNBC chart below, it really puts their profit transition into perspective.

Tesla has gone from a joke company run by a nut job, to the seventh largest constituent in the S&P 500. They dominate US electric car sales and have a market capitalisation of $635 billion.

We own quite a lot of Tesla shares for clients. They went from about $50 (on a split-adjusted basis) two years ago to as high as $900 on January 25th 2021, a spectacular run. Today they trade around $665 per share. So, it's been a bumpy ride.

Notably, Tesla is now making lots of money from selling cars, not just regulatory credits. On top of their massive Model 3 production, they are moving to produce Model Y cars next, and will get to the odd-looking Cybertrucks later. They also reported over $800 million in revenue from their energy business, including solar photovoltaics and energy storage systems for homes, businesses and utilities. That's up by more than 60% from last quarter.

There's a lot more growth that could come from selling those big battery packs. Elon Musk noted that there is probably demand for "in excess of a million Powerwalls per year", and an unspecified but vast amount of Megapacks for power utilities.

We still think that Tesla is a buy at current share price levels. Their revenue and profits are set to grow rapidly again in the year ahead. In many regions of the world, sales of internal combustion engines will soon be banned. Their leadership in EVs (and the ecosystem that includes a charging network, solar, and storage) and automotive technology (including powertrain and software) position them well in the long-term.