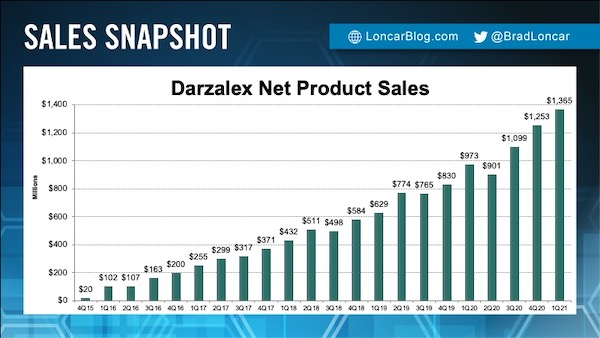

Johnson & Johnson results for the first quarter were out yesterday and I'm pleased to say that they looked pretty good. Sales of pharma products were strong, especially for cancer drugs Darzalex (see below) and Imbruvica.

Profits from their big medical devices business were solid, and sales in the consumer products business were satisfactory. The quarterly dividend was hiked by 5% to $1.06 per share. It won't go down again, it never does. That puts them on a 2.5% annual yield. Very safe and very generous!

In other news, the Johnson & Johnson Covid vaccine seems set to be re-approved soon. As you probably know, it's use was paused as a result of concerns about very rare (1 in a million) cases of blood-clotting. On Tuesday the European Medicines Agency gave it the all-clear, with some change to the labelling. The US CDCs will likely follow suit soon. Keep in mind that making vaccines is not a very profitable business, so this is a reputational issue, rather than a valuation concern.

Johnson & Johnson is the world's largest and most broadly-based health care company. That's why we encourage all clients in New York to own it as an anchor portfolio holding.