Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Right, next up in my review of the virus impact on our major holdings is payments processor Visa. As I said yesterday, we need to try to pinpoint how the changed world that we live in now will impact on their revenue and profitability, and decide if we are still comfortable to hold their shares at current prices.

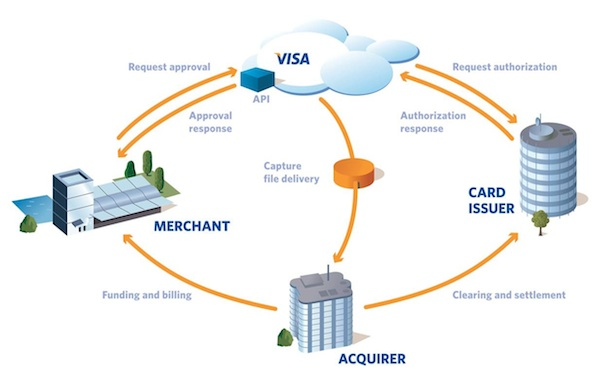

Visa has a highly digital business model, as you can see in the picture below. Its network connects banks and merchants via a web of sophisticated, always-online databases, enabling them to move money about and earn interchange fees. The San Francisco-based firm now connects more than 61 million merchants to 3.4 billion Visa-branded, bank-issued cards. The value of transactions last year was $9 trillion, which is equivalent to over a tenth of global GDP. Before this Covid-19 debacle, Visa's revenues grew by around 10% a year, reaching $23 billion in 2019. Naturally the share price did very well!

The virus outbreak has probably had very limited impact on their operations, but the lockdown is resulting in significantly lower transaction turnover, especially the highly profitable multi-currency travel and cross-border business.

On the 30th of March Visa once again lowered its outlook for revenue growth in the fiscal second quarter. They now expect revenue to be up only by a percentage "in the high end of mid-single-digit" range for the three months through March, while expenses are likely to climb by a percentage in the "low end of high single digits."

Again, keep in mind that the price of Visa shares has already adjusted to this new reality. The stock traded at an all-time high of $214.17 per share on the 20th of February, and is now at just $153.11. That's a nasty slide of 28.5%.

One more thing. In February, Visa announced quite a significant shift in its business model in the US, tweaking the rates that merchants pay to accept its cards. Rates were raised for transactions online, and on e-commerce sites including Uber. For example the fee on a $100 transaction on a traditional Visa card will climb from $1.90 to $1.99. For premium Visa cards, the fee will rise from $2.50 to $2.60.

Fees were lowered at the point of sale at major retailers, on real estate transactions and at education companies. On premium-card transaction of $50 for the category that includes large supermarkets, the interchange fee will drop 33%, to 77 cents from $1.15. These changes are also positive in the light of the recent shift to more online purchases.

The Economist pointed out in a recent article that Visa is now the world's most valuable financial-services company. Even though Visa's share price has been clobbered it has suffered less than the megabanks, whose share prices have fallen further.

In the long term, Visa has an even brighter future. People are growing more averse to handling grubby banknotes. In my opinion, one can safely accumulate Visa shares at the current level.