Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The medical devices, pharmaceutical and consumer goods giant Johnson and Johnson (J&J), reported a mixed set of fourth-quarter numbers after a tough year on the litigation front. The company's profit beat expectations thanks to the resilience of the pharma business, good growth in medical devices, and improved profitability in the consumer business. However the numbers are a little light on the revenue front.

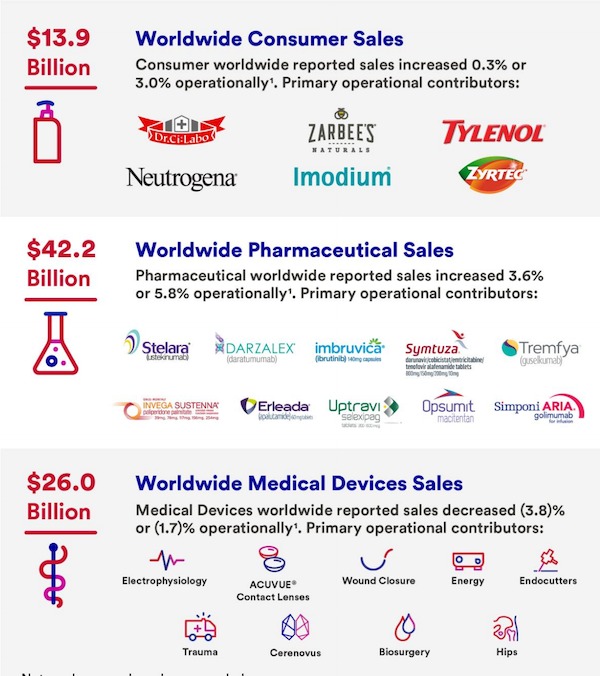

J&J reported fourth-quarter worldwide sales of $20.7 billion. Up 1.7%, missing expectations by a sliver. But if you exclude all new acquisitions/divestiture on an operational basis, then sales were up 3.4%. Full year revenues came in at $82.1 billion, up 4.5% excluding acquisitions/divestitures. Here is the segmental revenue split for the company:

Pharmaceuticals, a business that makes up about half of the overall sales, the cancer drug Imbruvica (sales up 42.1%) and the psoriasis treatment Stelara (sales up 6.6%) didn't perform as expected. Pharma companies were pressured to freeze prescription drug prices in the US, coupled with a lot of competition on the generics side.

Old drugs like Remicade for arthritis and Darzalex for multiple Myeloma are still the biggest contributors to the top line with company revenues of $6.2 billion for the fourth quarter. J&J strongly believes that its branded products could hold its own against biosimilar and generic products, which so far has been very true.

The company has made a lot of progress with their lawsuits, winning some of their appeals. Litigation expenses for the quarter were down to $264 million as compared to $1.29 billion a year earlier. Unfortunately, these pharmaceutical companies are soft targets for commission hungry lawyers who don't have anything to lose from filing lawsuits.

We expect more good news from J&J as favourable rulings comes their way when scientific evidence on the talc-based baby powder is released. This should nullify a lot of cases, therefore lowering the risk of continued massive legal bills.

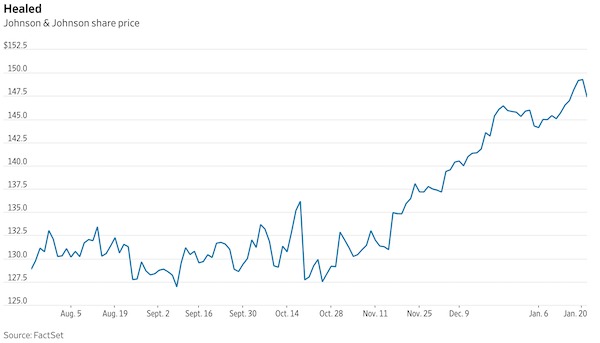

J&J forecasts that its revenues will be between $85.4 billion and $86.2 billion and earnings per share between $8.95 and $9.10, a very conservative range for 2020. Remember J&J shares usually trades at a premium to the market, but today they trade at an attractive forward multiple of 16 as compared to the S&P 500 multiple of 18. We are buyers of the company at these levels