Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The largest consumer internet company in Europe, Prosus released its interim results for the half-year ending in September. This is the first set of numbers after the unbundling by Naspers. Just to refresh, the company has a 31% stake in Chinese internet giant Tencent, OLX, mail.ru, Swiggy, Auto-trader, and MakeMytrip.

Given that Prosus and Naspers are basically the same company, we will have a look at their results in conjunction. Prosus' holding company Naspers saw revenues go up by 20% to $10.2 billion, and trading profits up 9% to $1.9 billion. Basically all of the revenues now comes from the internet/online businesses. Key segments that contributed to both top and bottom line growth are classifieds, payment & fintech, and food delivery.

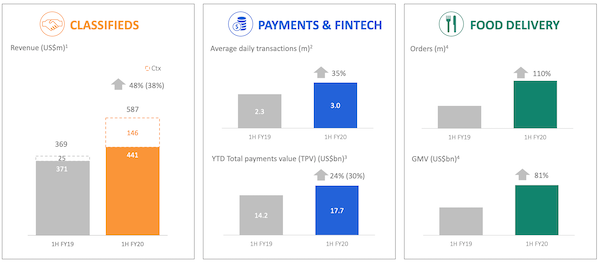

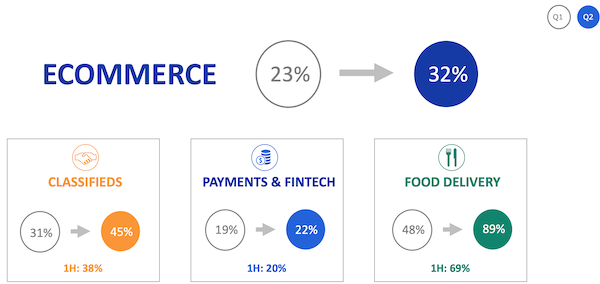

The chart below shows how all three key segments have performed in the six months under review. All three segments have shown accelerating growth in very competitive environments. The classifieds, and payments & fintech businesses are now profitable and the company continues to invest further.

The company is betting the farm on food delivery. My colleague Byron recently wrote about Prosus making a $6.3 billion cash offer for UK listed food delivery company Just Eat. The company says it still has cash on hand to the tune of $5.9 billion set aside for potential deals in the near future.

A week ago my colleague Mike wrote about Tencent; where it showed continued healthy growth in revenues thanks to continued growth in payments and fintech. What caught my attention is that Tencent's own investments are worth over $100 billion and are priced below their NAV.

One boss move that Prosus made was to exchanged its 42.5% stake in MakeMyTrip for a 5.6% stake in the larger listed entity Ctrip. This led to actual realised gains of $600 million, and meant they now have exposure to both Indian and Chinese tourism sectors. Other new investments include Red Dot Payments in Asia, Meesho, Wibmo, Carousell OLX, Brainly, Zoop etc. which all cost the company around $374 million in total.

The big focus to drive scale and profitability will still be in the core businesses - classifieds, payments & fintech, and e-commerce. The big investment into food delivery will continue to grow the market position for long-term benefit.

Most importantly Naspers has managed to unlock value to the tune of $14 billion with $4 billion coming from the Multichoice unbundling and the $10 billion coming from Prosus unbundling. We think buying Naspers and Prosus is securing your seat in a rocket ship to making money online.