As mentioned on Monday, Naspers published their full year results on Friday last week. Let's get the boring numbers out of the way first; revenue was up 29%, trading profit was up 22% and core headline earnings were up 26%. That is some impressive growth!

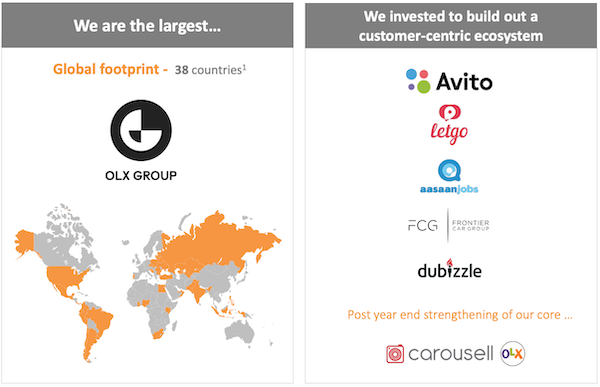

Those numbers don't mean much though when it comes to the Naspers share price. What matters much more is the changing value of their underlying investments. The biggest piece is Tencent. The next most important is division is online classifieds, which is predominantly branded as OLX. Have a look at how many regions it operates in, it is truly global.

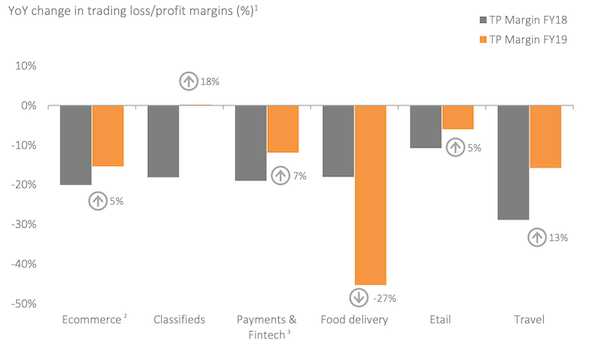

Notably, the classifieds business is making a profit for the first time. So now they have this one, Tencent and Mail.ru investments that are profitable. The rest are in startup mode, losing cash. This is partly why the analyst community struggles to put a value on Naspers. On the one hand, you have Tencent that is massive and paying dividends, on the other, you have smaller businesses that are growing rapidly but are loss making. Here is a look at how far along the road to profitability each business segment is.

Overall, we still think Naspers is a great investment. They trade at a 30% to 35% discount to their underlying assets. The company also gives you indirect exposure to the Chinese economy, which is still growing rapidly (It may have slowed to 6%, but that is still acceptable). Naspers is exposed to global internet companies that will be entrenched in our lives in years to come.