Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We consider online travel agencies to be an exciting investment opportunity. Thanks mostly to cheaper flights, making both local and international travel more popular and affordable. Culturally, it is becoming normal for both young and older people to visit other countries. We own shares of the largest listed online travel company, Booking.com but there are others like Expedia, Tripadvisor, Ctrip and Trivago. Airbnb is not listed yet.

†

One thing that I have noticed in recent industry reviews is the complaint that there are simply not enough hotel beds to sell. In other words, hotel occupancies are too high, limiting growth. It's taking time for hotel property developers to catch up.

†

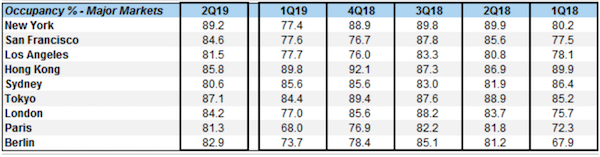

Here is a table from Smith Travel Research (STR), an American company based in Tennessee, that tracks supply and demand data for the global hotel industry. What it shows is that hotels in major urban tourist destinations around the world are basically full. Note that a hotel occupancy rate of around 85 percent is considered ideal, because the cost of managing anything higher is very high in terms of cleaning and other staff resources.

†

†

There is some seasonal variation in the data. For example, New York, which is horrible in the first quarter of the year (it's freezing there from the start of January to the end of March) is "only" 77.4% full. It's 90% full for the rest of the time.

†

Booking.com†reports its quarterly numbers on Wednesday after the market close. We expect them to make about $22 per share of earnings, which is about 15% higher than this time last year.