Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Payments processing giant Visa reported second quarter earnings numbers last night. The San Francisco-based company has market value of over $400 billion, and is the largest portfolio holding in most Vestact customer accounts.

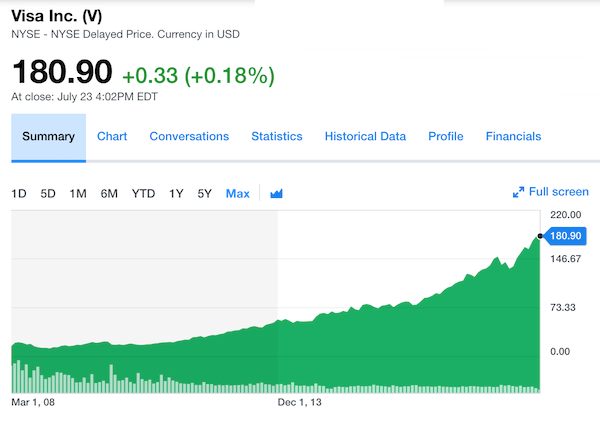

Visa delivered a solid quarter and reiterated its full year 2019 revenue outlook, whilst slightly raising its profit guidance. The stock price has already had a tremendous run, and remained around its all-time high in after-market trading. Visa shares are up 37% year to date, compared to the S&P 500 which is up "just"20%. Just look at this 10-year chart, it brings tears of joy to my eyes!

The total value of payments through the Visa system for the three month period was $2.23 trillion (up 4.9% year-on-year or 8.7% in constant currency). That's a lot of money gushing around, and Visa earns a little piece of the action on every transfer. The global economy is growing, but not all that fast. However, the shift from paper money to card and mobile payments is ongoing, so their growth rate is higher than that of the retail economy. We expect Visa to rake in revenue of about $23 billion for the full financial year.

The regional split of the current payments flow is interesting, and remember that this is split between credit and debit card transactions. About half is in the US, another 20% each is from the Europe and Asia Pacific regions. The last 10% is equally split between Latin America and the Middle East and Africa. There is growth potential everywhere!

There were some other pleasing developments. Cross-border volumes are moving higher, which is great because any transaction with a currency switch is very, very profitable for Visa. A lot of that is linked to people travelling, using their home-currency bank cards to book air tickets and hotels, and then shop and pay for meals on the go.

We have pointed out before that Visa's most important clients are the point-of-sale merchants and the banks. Visa's payment network makes it possible for those two groups to serve you, the end customer. An important relationship with JP Morgan was renewed to 2029.

Other initiatives include Visa Direct which is used for person-to-person payments, insurance premium collections and payouts, and instant payroll payments. Remember that mobile payments and online transactions may not deploy an actual plastic credit card, but still utilise the Visa system.

Most brokerage houses have medium-term share price targets for Visa stock of around $200 per share. We are happy to hold this stock forever, and to accumulate it for clients at current levels.