Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

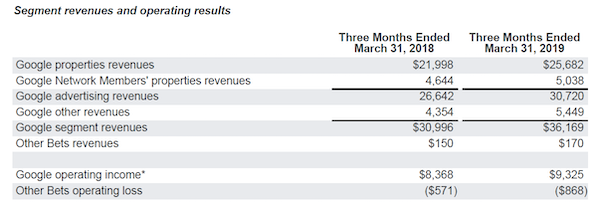

Google reported numbers on Monday which disappointed the market. Revenues came in at $36.34bn vs consensus of $37.3bn. This showed a growth rate of 19%. Excluding the once-off EU fine, net income was $8.3bn which equates to $11.9 a share. The below image shows where Google makes their money.

As you can see, advertising makes up 85% of the company's revenues. That "other revenue" segment includes Google Play, Google Cloud and Hardware. Google Play (content) and Google Cloud have huge potential and have been the recipients of some heavy investing.

The market was concerned with advertising revenues. Facebook reported a 26% growth in sales versus Google's 15%. Apparently more than 50% of US online shoppers now go straight to Amazon instead of searching for the item on Google. That is why Amazon advertising is thriving. Anyone who said this business is a monopoly is very wrong.

Having said that, we still see massive potential for Google. Ruth Porat, the CFO, said that nearly half of ad budgets in the US are still offline. Advertising online is still off a low base and there is certainly room for plenty of players in this space. Think of all the separate print media houses competing for space a few decades ago.

They still rule search with 92.4% market share worldwide. That has huge value. We think search and advertising will continue to do well but the big upside potential will come from content (sold to their android users), cloud, gaming (Stadia), Youtube (streaming videos and music) and many other services targeted towards their user base.

The fundamentals are very strong. Expectations are for them to make $52.37 next year. This means they trade at 22 times next years earnings. The company has net cash of $110bn. That is unbelievable. Correct me if I am wrong, but the cash piles these tech companies have accumulated is unprecedented. If you strip out the cash the company trades at 19 times earnings. For a company that is expected to grow earnings 20% per annum, that is cheaper than most of the other stocks we analyse in the US. We see this pull back as a great buying opportunity.