On Tuesday after the US market closed, Stryker released their latest quarters results. Continuing the form of other companies, Stryker beat both on revenue and earrings. Even though the company beat analyst expectations, share were down yesterday. I suppose it shows that the market is expecting big beats.

For the quarter their revenue increased 8.5% to $3.5 billion and their EPS increased by 11.9% to $1.88 per share. A common trend with these large multi-national US companies is the impact of a stronger Dollar on their results. In the case of Stryker, it shaved off 2.1% of their top-line growth.

Stryker is always on the hunt for smaller specialist companies that they can purchase and add to their portfolio. The risk of doing all the purchases is that growth only comes from acquisition and not from their current portfolio. The good news here is that 3.3% of the top-line growth came from acquisitions, 7.3% was organic growth.

Along with the increase in sales came a slight bump higher in their operating margin, to 25.1%. Those are some healthy margins! With all the cash they are producing they were able to lower their long-term debt levels, even though they have been buying companies over the last 12-months.

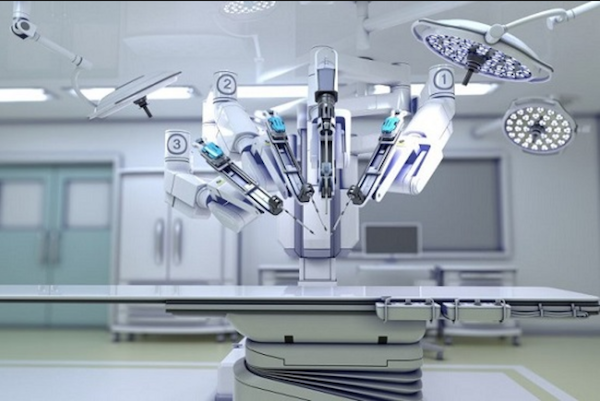

Stryker is one of the leading companies in the growing medical devices industry. Even with the good growth record from the company, it 'only' trades at a 20 times multiple. Which in my opinion is great value for money at the moment!