Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Monday Johnson & Johnson reported earnings for their first quarter of the year. Sales were flat, sitting at around $20 billion whilst adjusted earnings advanced by 2% to $2.10 per share.

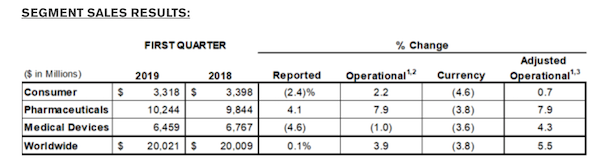

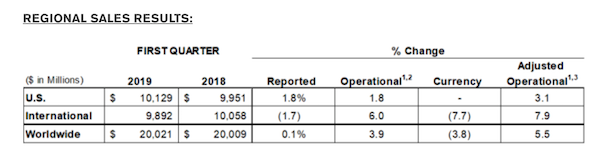

Take a look at the segmental and regional sales breakdown. This is an incredibly diverse business. Half of the group sales are from the US, the other half is from around the globe. There is a good spread between Consumer, Pharma and Medical Devices.

Pharma is the bulk of sales and had another good quarter. This was driven by solid sales of Stelara (treatment of immune-mediated inflammatory diseases), Imbruvica (lymph node cancer) and Darzalex (multiple myeloma). These are products that you hope that you never need to use, but they are crucial for the survival and quality of life of thousands of people around the world.

The Johnson & Johnson share price took a hit at the end of last year because Reuters investigative journalists dug up and published an old story about dodgy talcum powder manufactured by the company at talcum mines many decades ago which contained traces of asbestos. The timing of the expose was terrible, because there are pending lawsuits on the go which allege that talcum powder causes ovarian cancer. Notwithstanding the merits of that case, talcum powder represents less than 2% of the company's sales.

The Johnson & Johnson share price hit an all-time high of $147 in November last year, but fell to $123 per share in a gut-wrenching ten day period in December, thanks to that Reuters report. Note though that this happened in the middle of a general market sell off. It is now back up to around $138 a share. We think it should be even higher and see this as a good time to buy one of the bluest of blue chip shares.