Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

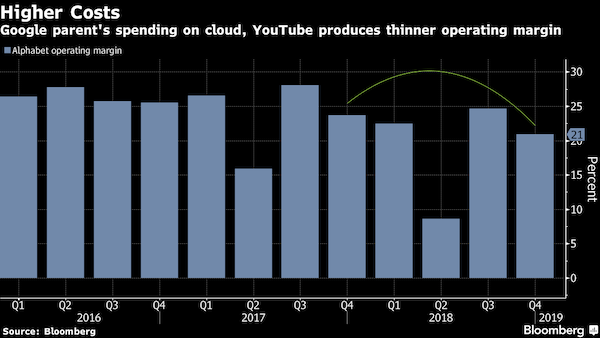

Monday after the market's close, Alphabet reported a very strong set of numbers, but which weren't really cheered by Mr market. Mr market was concerned about the CapEx expenditure put towards enhancing technical infrastructure, Google's cloud business and YouTube, which in turn has compromised margins.

Revenues for the fourth-quarter beat analysts expectations, less all the fees paid to partners, came in at $31.8 billion up 23% from last year. About 83% of the revenue is still attributable to the Google advertising business.

Capital expenditure for the quarter came in at $6.85 billion, up 64% from last year. The higher spending led to margin contraction from 24% to 21%.

The spending was on boosting cloud computing staff to service the new data centres, promoting consumer devices, buying new office buildings in New York City and Silicon Valley, as well as making YouTube subscription packages more competitive.

Sundar Pichai, CEO of Google said that "Google's cloud computing division doubled the number of $1 million deals it made. Google clouds' G suite productivity product now has over five million customers."

Google is obviously playing catch up with AWS and Azure in the cloud space, currently a strong number three. Any form of investing in the business should be encouraged as it helps the company stay twelve steps ahead of the competition in things like search, ride-hailing, and services.

Ramp Capital (a financial Twitter account) said that YouTube should stop paying 10 year olds $25 million a year to do toy reviews. I am totally against that because YouTube is nothing without the creators and that's why YouTube red hasn't really gained any momentum. Kids like Ryan, Pewdiepie, and other creators make the platform!

The big takeaway from these numbers is that Alphabet is slowly realising its dream of diversifying profits streams and dropping the "one-trick pony" stereotype. We like what Alphabet is morphing into, and like all good things, the outcome will be worth the wait.

Patient investors get rewarded dearly, so buy this one for the grandchildren!