Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Friday at 15:00 Naspers released their 6-month numbers. I love reading about how all their global operations are doing; Naspers offers us in Mzanzi the opportunity to invest in the global tech space. Generally speaking, the movements in the Tencent share price are more influential on Naspers than their results, it is still worth seeing how their other ventures are doing.

When valuing Naspers, I think you need to look at its NAV and then at its cash flows. Thanks to the sale of Flipkart, cash flows have been very strong. The group generated $123 million in interest from their 'dry powder', currently looking for a new home.

Thanks to a number of their assets being listed - Mail.ru, Delivery Hero, Make My Trip and the all-important Tencent- we can get a very quick and market-related value of their assets. Sticking the current share prices of those companies into a spreadsheet, I get a holding value of R1.66 trillion. If you then consider that Naspers current cash position is R120 billion higher than their long-term debt, you get a very rough asset value of R1.78 trillion. Remember all their unlisted assets are not included in this calculation.

As I write, Naspers's market cap is R1.27 trillion, a 45% discount to their listed assets and cash on hand. Over the last few years, there has been an increased talk from management to reduce that discount to NAV, pointing towards accelerated upside for current shareholders.

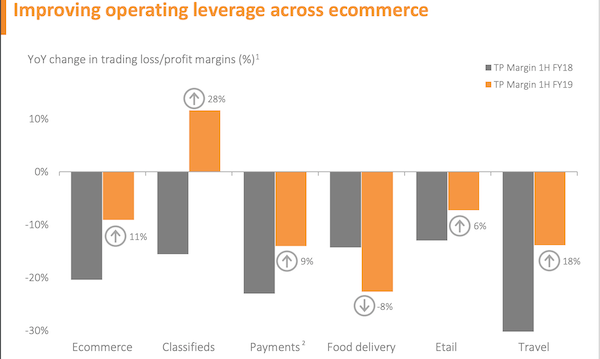

All the cash generated from Tencent and Multichoice is being reinvested in future industries, where most of those businesses are still loss making. Exciting for the group though is that their classified business has now reached a point where it is making a profit. Below is a break down of how each segment is doing.

All these industries require scale, where over the next decade only a handful of players will remain. Those players will then get to share in all the profits. Over the last 6-months the e-commerce division grew revenues by 46%, which is the number that counts at the moment.

In the past, management has been criticised that their only successful investment has been Tencent, and that all they do is ride Tencent's coat-tails . In their investor presentation, there was specific mention made to how their investments have performed, excluding Tencent. Management calculates that the IRR on their other assets is currently 22%, a number that any investment company would be happy with.

We still think that Naspers is an amazing investment, even though its share price is down 18% over the last year.