Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week Thursday, after the market closed, Amazon released third-quarter numbers. The numbers looked solid but the share price fell back 8%. In it's defence, the share price was up 7% the day before. The market has been very volatile of late making it is difficult to tell what is really moving the share price during this earnings season. Is it the numbers or is it market sentiment?

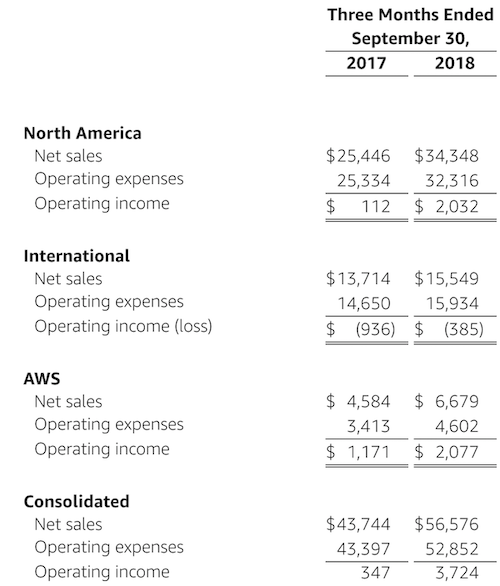

Sales for the quarter increased by 29% to $56.6bn. This resulted in operating cash flow of $26.6bn. If this company did not reinvest so much of its cash, it would be extremely profitable. The below table looks at sales and operating income via segment.

Growth was solid through all the segments. As you can see, AWS is very profitable and continues to grow fast. Sales for AWS grew by 46%. The rise of this business has been well timed for Amazon during a period when the cash hungry online retail business needed funding.

Remember when Amazon used to make a profit by mistake? That was the ongoing joke amongst analysts. They are expected to make profits of $15bn this year. Annual profits of $25bn are expected by the year 2020. The US business is starting to mature and reach its profit potential.

Why did the share price fall? Forward guidance was less than expected. A few accounting technicalities, as well as some holidays falling in and out of regular quarters, was the excuse. Nothing to be worried about. I think general market jitters had more to do with it.

Online retail, cloud computing, content consumption and online advertisements are all fast growing areas of the global economy. Amazon's execution in these areas is second to none. We think this is a fabulous business to own, especially after a 20% pullback in the share price.