Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Medical devices, pharmaceutical, and consumer goods giant Johnson & Johnson (J&J), reported expectation beating third-quarter numbers, thanks to good sales in the turnaround of the baby care business and cancer drugs. The company rebranded and relaunched its baby business after losing market share to the likes of Jessica Alba's The Honest Company.

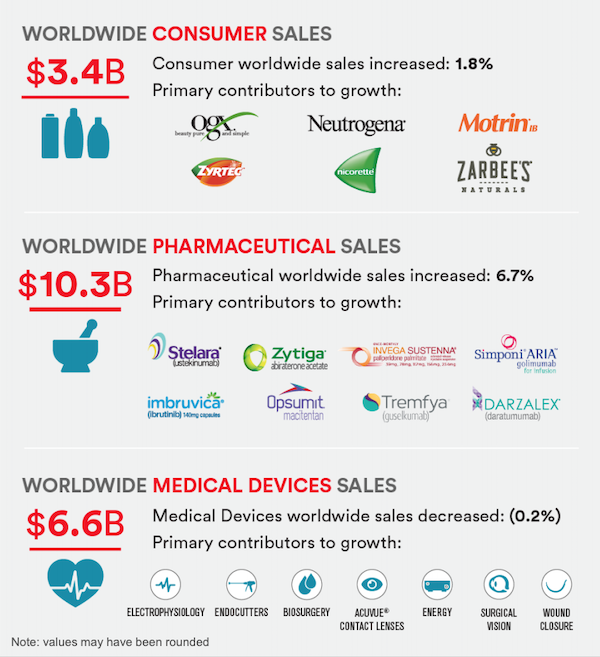

J&J reported third-quarter worldwide sales of $20.35 billion up 3.6%, but if you exclude all new acquisitions/divestures on an operational basis, the sales were up 6.1%, beating analysts expectation of $20.05 billion surveyed by Refinitiv. The segmental sales split is as follows:

Both the Pharmaceuticals and the Consumer businesses beat expectations thanks to accelerating sales momentum. However, the Medical devices business missed expectation by a small margin.

In the Pharmaceuticals business, the biggest division by sales, the shining stars were immunology drug Stelara, which helps in aiding plaque psoriasis, and oncology (cancer) drug Darzalex, bringing over $1.8 billion in sales. A month ago, J&J signed an agreement with Arrowhead Pharmaceuticals to develop gene-silencing Hepatitis B treatment in a deal that's worth over $3.7 billion. J&J will also take a minority stake in Arrowhead Pharma.

"Pharmaceuticals, I just can't say enough about that division for us… it continues to generate new products in a profound way that's transformational to the current state of care, and that's led the growth of our company for many quarters now" said J&Js CFO Joe Wolk on CNBC.

J&J sold its diabetes business LifeScan to Platinum Equity for $2.1 billion which shows that management is constantly reviewing its portfolio of assets to optimise shareholder returns. The baby care brand went through a thorough revamp by reformulating its products and getting rid of half its ingredients. J&J is removing all the junky ingredients such as sulphates, colourants/dyes and substituting it with superior, more natural ingredients like coconut oil. A hipster parents dream, I mean a woke millennial parents dream!

The medical devices business is seeing a lot of competition, and it's reflected on the operational growth or lack thereof. The Interventional solutions business saved the day with 18.1% sales growth driven by Atrial Fibrillation procedure (heart palpitations). Diabetes care and Orthopaedics are both stinking up the joint with sales contracting by 22.2% and 4.2% respectively. Overall the business avoided going backwards on sales.

Here at Vestact we subscribe to the "buy 'em cheap, buy 'em strong, and hold 'em long" school of thought. J&J fits slap bang in the middle of "buy 'em strong" because it has proven itself to be a quality business over a very very long period of time, with dividends that have been increasing for over 50 years straight! We plan to hold this one long.