Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Tuesday night we received excellent earnings from Apple. Almost every Vestact client in New York owns Apple, and we have recommended them for a very long time. This was their best June quarter ever. Remember, this is usually a dull period for Apple because there a no new product launches, and the festive season excitement has long gone. What was key here, was that even though iPhone sales only grew by 1%, revenues for iPhones increased by 20% because the iPhone X is much more expensive than previous products.

This is why Apple is such an amazing business. Most people who own an iPhone are already locked into their ecosystem, and are willing to pay a premium for staying in their comfort zone. What an amazing product (I love my iPhone X). Those who are not clients aspire to become one.

Overall, revenues grew by 17% to $53.27 billion. Profits rose 32% to $11.52bn or which comes out as $2.34 a share. Earnings for next year are expected to be around $14.44 per share. The stock currently trades at $202 a share after a handy 5% pop yesterday. That puts the stock at 13.7 times forward earnings. That is cheap compared to the rest of the market. So Apple has very sound fundamentals, especially when you consider that they have a cash pile which is now worth more than $200 billion.

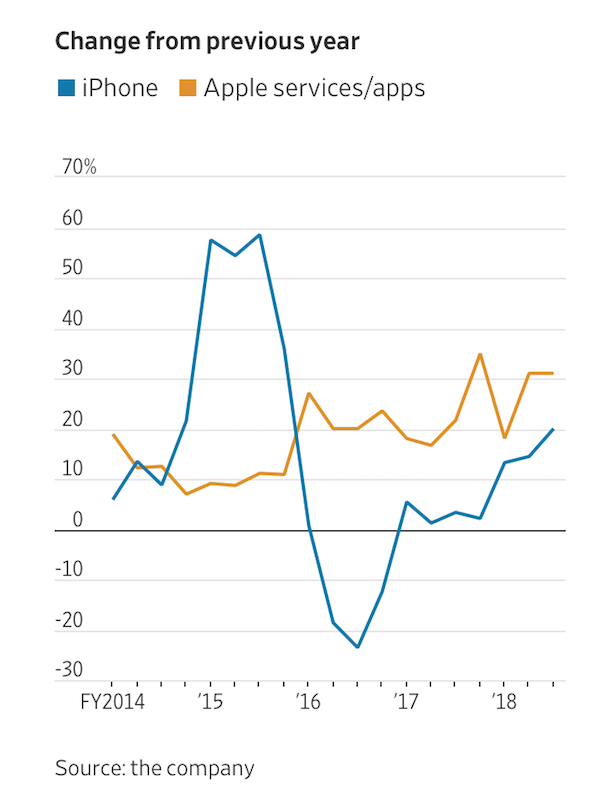

Another shining light in these numbers was the services business which grew revenue by 31% to $9.55bn. So these cash annuity subscriptions now generate nearly 20% of overall group revenues. Services, which includes apps, music, iCloud etc. has been a constant grower for the company. The graph below shows service growth versus the iPhone.

It is, of course, essential to keep churning out quality products to keep their clients consuming Apple services. I was astounded to read that only 25% of Apple devices currently use subscription services. That shows massive potential for growth, especially in iCloud subscriptions. It is only a matter of time before your photo album gets too big to store on a device. Come on people, back that up!

Apple still remains one of the most compelling investment opportunities around.