On Wednesday evening after the market closed, our biggest US holding, Visa reported earnings. Over the last 12-months, the stock is up 40% and over the previous 5-years it has tripled in value.

The company reported revenues of $5.2 billion, up 15%, and EPS of $1.00, up 16%. Both beating analysts estimates. We have spoken many times about Visa and MasterCard's war on cash, and how we think they will ultimately be the victors. That still looks to be the case.

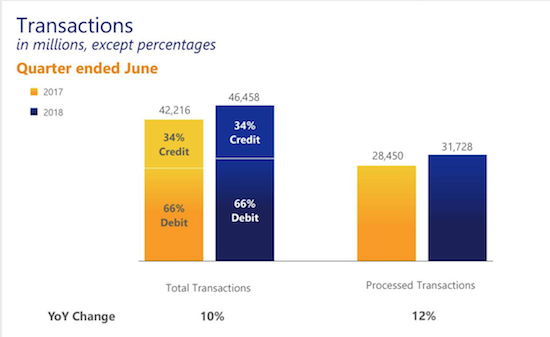

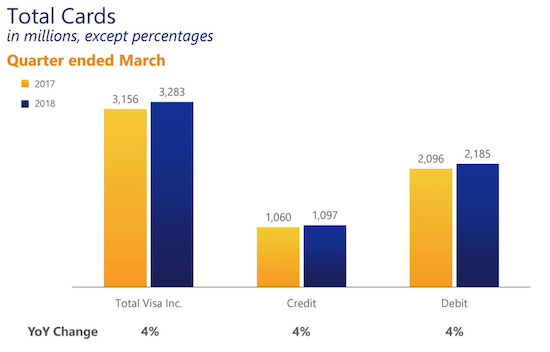

Reading through these latest results, I was struck again by the scale of Visa. Over the last 3-months, they processed 46.4 billion transactions and have 3.3 billion cards in issue! Just wow!

Another reason to own Visa is their exposure to the travel industry. Not only do most people book their flights and accommodation using their credit card, but they also spend big bucks while on holiday. These cross-boarder transactions give Visa even higher margins than your normal day-to-day swipes. So not only should you buy Visa stock based on them beating cash, but also to take advantage of millennials need to travel.