Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday I spent the morning reading through Naspers remuneration reports from their last two financial years. Executive remuneration is always a tough subject to approach. What is the appropriate amount to pay the leaders of these multinational organisations? As I have said many times before, at the end of the day, it is a shareholder decision, and if shareholders don't object at the AGM then they can't complain. Also if you are not a shareholder, other things in South Africa are much more worthy of getting hot and bothered about.

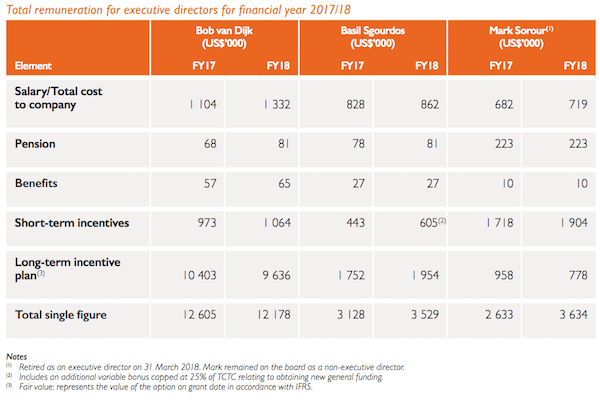

Here is the official remuneration numbers for the top executives.

Those numbers don't look inflated given that Naspers is a $100 billion company. For comparison, Nike has a similar market cap, Mark Parker the CEO there earned $13.9 million last year. Some of you will look at those numbers and say that you read in the media that Bob van Dijk earned R1.6 billion, not $12 million? This is where things get tricky, do you measure share incentives at the share price when they were awarded or at the share price when the lock-up period expires?

In the case of Naspers's new CEO, he was awarded share options in 2014 when the Naspers share price was R1 155 a share. The agreed on incentive package was that he could buy 284 031 shares a year at around R685 a share. At the time it was awarded, that valued the incentives at approximately $10 million a year; fair I would say?

We fast forward to 2017 and 2018 when those share options come due. The Naspers share price has more than doubled from R1 155, meaning that Bod van Dijks share options are now worth around $55 million. It is worth noting that over the coming financial years, Bob van Dijk will continue to get paid out shares. When his current incentive scheme is complete, he will have options on 1 000 000 Naspers shares. These are not shares that he gets for free, but at a massive discount to the prevailing Naspers share price.

As Byron noted yesterday, if the Naspers share price had collapsed from R1 155 to R600 after Bob joined as CEO (many investment analysts at the time were predicting this), we would not be having this discussion because his share options would be worth zero, nada, nothing. It is only due to the massive success of Naspers that this is a talking point.