Have you ever tried searching for something on a website and then get frustrated because the search function cannot predict what you are thinking? Google has done that to you. The Google search function is so fantastic that searching for anything that is not supported by Google is incredibly frustrating.

CFO of Alphabet, Ruth Porat, has said that this is one of the reasons that theQ2 results released last night were so solid. They have invested heavily in the user experience of all their products, and it is paying off.

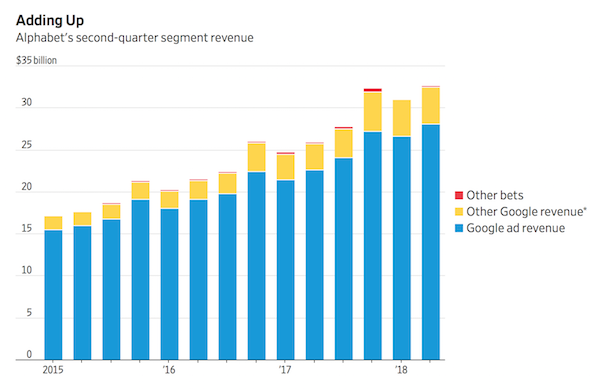

Revenues were up 26% to $32.7 billion. That resulted in net income (before that ridiculous $5bn fine) of $8.3bn. That is massive. They could pay off Eskom's debt in about a year with those profits. This equated to $11.75 per share. For 2019 the company is expected to make $46 per share. This means Alphabet trades at 23 times 2019 earnings if you strip out the $100bn cash pile they sit on.

The below image shows their revenues in a nutshell. Yes, Ads is still dominating, but that yellow contribution is growing. Other Google Revenues includes their cloud business and app sales. Much like Apple's services businesses. A while back we even worked out that Google's cloud business actually backs Apple Cloud.

Most importantly, Ads seems to be thriving. Google expects to own 31% of the global ad market this year. The next biggest competitor is Facebook, which we also own.

This is an absolutely amazing business that spews cash and is constantly innovating. We are aggressive buyers at these levels.