Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Johnson & Johnson is a mega-cap ($354 billion) healthcare giant, owned by most Vestact clients in New York portfolios. It published quarterly results yesterday, before the opening bell. Earnings came in notably higher than expected, and the stock rose 3.5% over the course of the day, to $129.11.

The pharmaceutical division was the standout performer, with key products like Zytiga, Stelara, Remicade and Traceleer (from the recently acquired Actelion portfolio) all doing well.

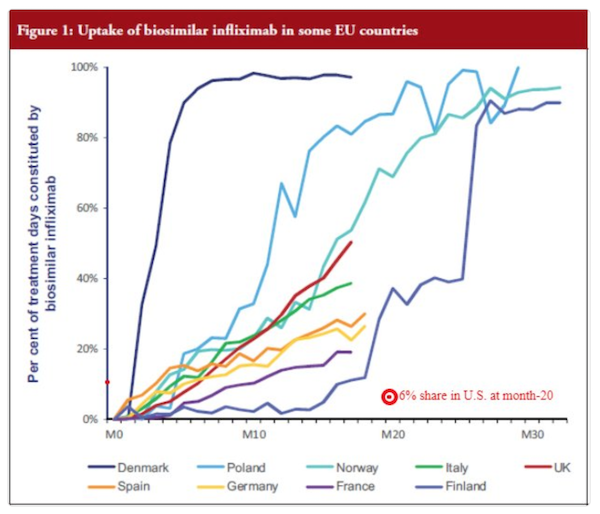

As a matter of interest, I recently saw this chart below, which showed that despite the existence of two generic versions, US doctors continue to prescribe Remicade for autoimmune diseases such as Crohn's disease and rheumatoid arthritis. The drug still has a 94% market share. In Europe, that has not been the case, where the generic versions have sold well.

Johnson & Johnson's medical device division continues to underperform a little. Maybe they should sell it to Stryker? Not likely, but I'm just saying.

The performance of their consumer division was also a bit flat, affected by soft demand in some regions, a logistics setback in Brazil and currency effects.

Management did not rule out another Actelion-sized deal (around $30 billion). According to Goldman Sachs, Johnson & Johnson has about $112bn in "cumulative firepower" over 2018-2021. Must be nice?

Johnson & Johnson's share price has been stuck at around $130 for the last two years. After a period of relative underperformance, it's looking better. This is a good time to buy some more for your portfolio.