Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tesla released a "not so bad" set of first quarter numbers versus analysts expectations seeing all-time record Q1 orders for the flagship Models S, 3 and X. The company produced 24 728 Model S & X, 9 766 Model 3 and delivered 21 815 Model S & X and 8 182 in the quarter.

The pioneer in electric-vehicle and next-generation battery technology reported revenues of $3.4 billion and a loss of $3.35 per share, a big miss versus the streets $2.04 loss expectations.

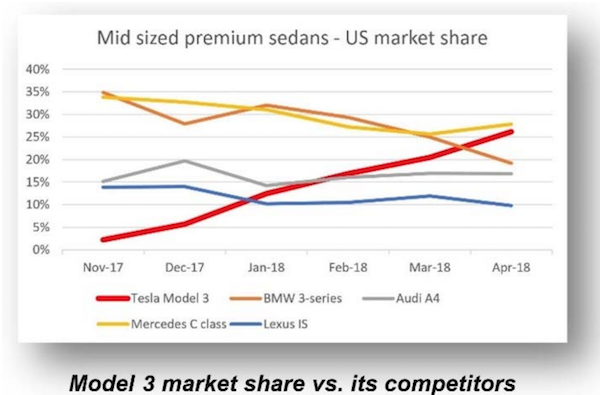

In his letter to shareholders, Elon Musk says that there's been huge progress with the new Model 3 volume ramp up, to a point where the company produced more than 2 000 Model 3 vehicles for three straight weeks and 2 270 during the last of those three weeks. A new record that might help the company climb to be the best-selling mid-sized premium sedan in the US if this kind of production continues. The Model 3 is already taking market share from the competition.

Musk is focusing Tesla's energy on reaching the weekly volume goal for the Model 3 of 5000 units. This goal will boost the Model 3 margins, taking that production line to break-even in the second quarter and then a more positive outcome for shareholders in the third or fourth quarter, yes the "P" word profits.

Most of the Model 3 pain points were due to a quick transition from manual processing to automated. In some instances this helps a lot, but in more delicate manufacturing processes like the battery module it ended up resulting in more unplanned stoppages. The Tesla team is hard at work right now as they're in a ten-day planned maintenance schedule to semi-automate the battery module processes to reach that 5 000 units a week goal.

Once the company hits its 5 000 units a week goal, Musk has promised to continue increasing output all the way to 10 000 Model 3 units per week. He will do that by incorporating their learnings from the past; an old Japanese approach referred to as the Kaizen model.

Things got wild at the conference call when Elon Musk referred to a sell-side analysts question as "boring, bonehead and trivial". To those who missed it, the questions were about "cash flows" and "why can't you make enough Teslas". No defence to Elon's colourful approach but this is a bit annoying because he's addressed this in the second paragraph of his letter to shareholders, it just shows that some analysts don't do the required reading!

Tesla sits on a cash pile of $2.7 billion compared to $3.4 billion at the end of last year. Customer deposits have soared 15% to $985 million for the Model 3 and the Roadster. Musk said, "we have significantly cut back our CapEx projections by focusing on critical near-term needs that benefit us primarily in the next couple of years". He has also promised that Tesla will not tap into shareholders or debt markets for capital in the coming quarters.

The company is no longer a hope stock; it is slowly becoming an electric auto manufacturing giant. However, does it warrant the current valuation of $50 billion with a forward PE of infinity? That remains to be seen!