Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

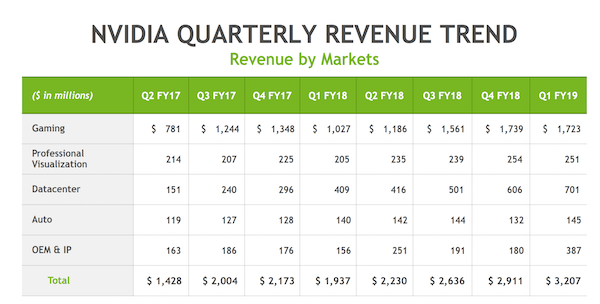

On Thursday after the market closed,Nvidia, one of our smaller holdings, reported blockbuster numbers. Here they are. Revenue grew 66% to $3.2bn, Net Income grew by 145% to $1.2bn, and thanks to share buy-backs EPS was up even more by 151% to $1.98.

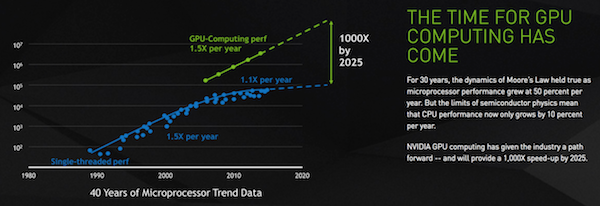

As society moves toward being more data-centric, CPU's are just not efficient enough to plough through all the data to get to the desired outcomes. GPU's are the answer, and Nvidia is the leader by some margin. GPU's are 50-200 times quicker than CPU's at data crunching, which means it is much cheaper, more energy-efficient and less space is required when you use a GPU.

Found here

Gaming is still their biggest division, where revenue grew 68% to $1.72 billion. Part of this market are people buying GPU's to mine cryptocurrencies, which has created a situation where demand still outstrips supply for their cards. Due to a lower Bitcoin price and a lower ROI on mining cryptocurrencies, Nvidia says demand from the Crypto market will be only 1/3 in 2Q than it was in 1Q. As Byron pointed out in the office, the demand for GPU's from the crypto market lags the Bitcoin price by 3-months.

In the Q&A section of the analyst call, the company speaks about blockbuster games having a noticeable impact on an increase in gaming demand. As more people hear about these games and start playing them, they then rope in more people to play. Then the cycle repeats itself. Gaming is becoming more mainstream, which is what you want as a Nvidia shareholder.

Their really exciting division is the one selling to datacenters. In this division, revenue grew by 71% to $701 million. Based on Nvidia's forecasts, they estimate that datacenters alone will need $50 billion worth of GPU's by 2023!

If we assume that Nvidia will still be the dominant force in GPU's going forward, they will be printing cash. This is a reasonable assumption because analysts estimate that Nvidia is around 18-24 months ahead of their competition regarding their technology. To maintain that lead Nvidia spent $542 million in the last quarter on R&D, out of total operating expenses of $773 million. Spending 17% of revenue on R&D is good going. Here is a look at how their revenue has been growing over the last few quarters.

For all this growth, you have to pay-up. The stock trades on a forward P/E of 36 times. Based on this quarter's results though, I think 36 times doesn't assume enough underlying growth. Nvidia has been one of the top performing shares in the US recently, profits are up 150% over the last 12-months, but the share price is only up 100%; meaning the stock is getting cheaper on a relative basis!