Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

iPhone maker Apple is the second most widely held stock in Vestact client New York portfolios. It put out the first quarter (January to end-March) results after the market closed on Wall Street last night. They topped expectations, and the share price rose by another 4% in late trade, to $175 per share.

iPhone revenues, which some (not us) expected to be weak, exceeded $38 billion, up 14% year over year. They sold an amazing 52.2 iPhones in the period. One of those was mine! Thanks to sales of the new iPhone X, which retails for $1,000 or more, the average selling price for Apple's smartphone lineup is above $700, after averaging about $640 for the last few years.

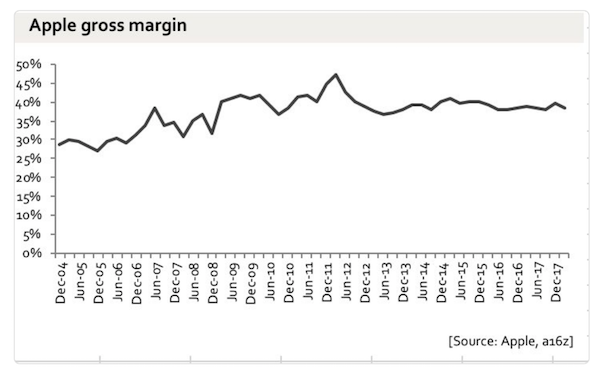

Apple's margins are a thing of beauty! Look at this chart. Humming along at around 40%. This is not some startup, it's the world's most valuable company with a market capitalisation of $857 billion. This speaks to the value that people find in their latest devices.

Apple's services business grew 31% year over year to reach revenue of $9.2 billion for the quarter. This is subscription income from things like Apple Music, iCloud storage and revenues from apps.

Significantly for us shareholders, Apple is beginning to deal with its huge offshore cash hoard. It announced a new $100 billion buyback plan. Remember, fewer shares in issue means more profits (per share) for those of us who elect to stay holding firm. Plus the company will always be on the bid, buying shares at times of weakness, smoothing the ride. The quarterly dividend will also be boosted by 16%.

In case you feel like you missed out on buying these, don't worry, you didn't. Even at $175 a share, the stock trades on a price to earnings ratio of just 14. That's well below the US market average of about 18 times. If you have some already, buy some more.

I was discussing investing with a group of friends over the weekend, and one asked me for some stocks that were undervalued and due for a quick share price pop. I told him that I was not really interested in that kind of trading/gambling. We are attracted to investments in companies that seem to be well positioned to benefit from emerging changes in societal behaviours or consumption patterns. Apple is a great example. Buy them at the current price, and go along for the ride.