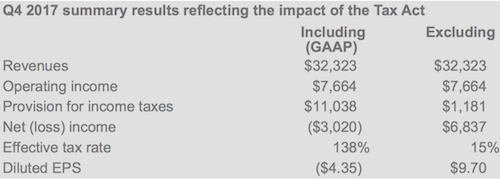

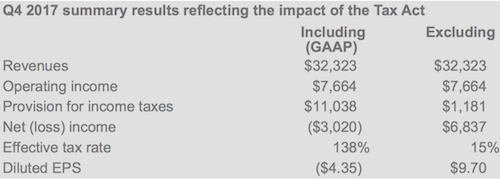

On the 1st of February, Alphabet/Google blessed us with financials for the last quarter of the year, as well as the full-year numbers for the year ending on 31 December 2017. The company missed earnings expectations, with $9.70 per share coming in just under the $9.98 forecast. Shares were down 5% in after-hours trading when those numbers came out.

The amazing and not so new Ruth Porat, CFO of Alphabet, opened by saying the following on the earnings call:

"Our business is driving great growth, with 2017 revenues of $110.9 billion, up 23% year on year, and fourth quarter revenues of $32.3 billion, up 24% year on year. Our full year operating income growth continues to underscore our core strength, and on top of this, we continue to make substantial investments for the long-term in exciting new businesses,"

Now in English, "The business is growing from strength to strength. 2017 was our record year and record quarter, and we will continue to seek out more complimentary opportunities to continue to grow our business."

This amazing one-trick pony posted an

all-time record for advertising sales which is now 85% of revenues. These ads are the ones we see on our smartphones and at the beginning of a YouTube video. The only problem with the smartphone ads is that they bring home less bacon than the traditional desktop/laptop ads. This will change over time as engagement increases on mobile due to larger screens. Google's cost-per-click, what advertisers pay each time someone clicks on an ad, declined 14% for the quarter, this will stabilise over time.

However, Alphabet

posted a net loss of $3 billion for the quarter due to a $9.9 billion once off charge tied to changes in the US tax system. This is not a surprise at all as we have seen banks reporting similar tax charges. Thank you Trump?

Google is still the largest, most dominant search-engine by miles thanks to its positioning as the default search engine on Chrome and on mobile phones. Sometimes Google has to pay the likes of Apple to be the default search engine on their Safari browser and this payment is referred to as traffic-acquisition costs or TAC.

TAC was 24% of Google's advertising revenues, which was up 33% year-on-year. According to the lovely Ruth Porat, Mobile Search and something called "Programmatic advertising" carry the highest TAC.

"Other revenues" which include sales from Google's Cloud Business, The Pixel Phone, YouTube Red, Google's Smart Speaker, Google Play Music etc.

came to $4.7 billion for the 4th quarter, up 37% year-on-year and was 15% of Google's overall revenues thanks to the strong holiday sales.

Alphabet's "other bets" which include their self-driving car business Waymo, smart-home hardware provider Nest, and their fibre-to-home business Fiber, are still loss-making businesses.

Alphabet's shares were up just over 30% for the year of 2017, they're up 6.5% year-to-date at time of writing, valuing the company at $775 Billion. The company continues to buy back more shares, the board has authorised to buy-back a further $8.6 billion worth of its Class C shares. If you strip out the once-off tax item, the historic price-to-earnings ratio of 35 and a forward price-to-earnings ratio of around 29 is still relatively cheap for a high-growth technology company.